November 2023 monthly market insights

Data and opinions as of October 31, 2023

Long term yields spook markets in October

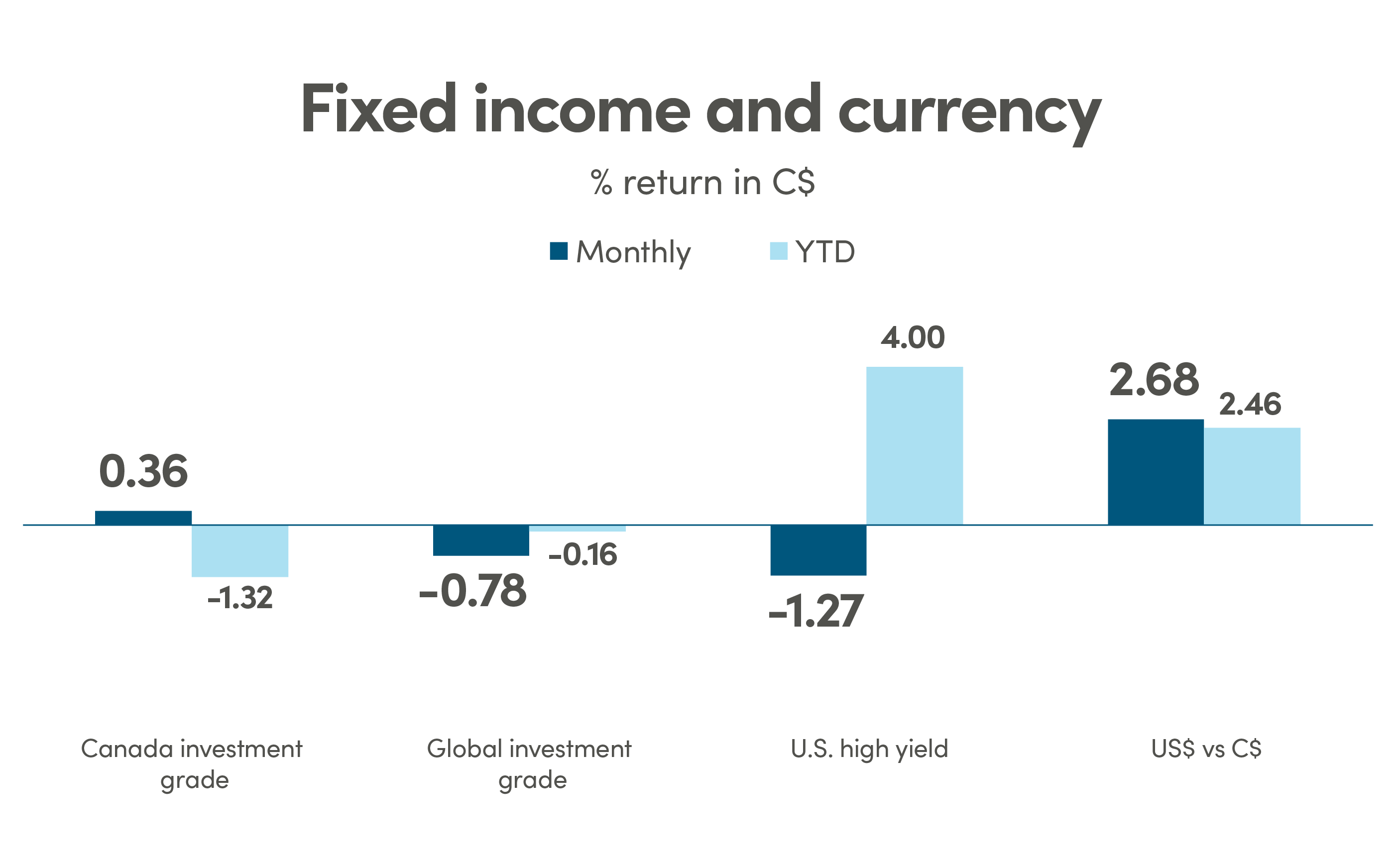

Both equity and fixed income markets continued their fall in October as bond yields rose sharply, while heightened geopolitical uncertainty also weighed on market sentiment. In fixed income markets, government bond returns were negative across a number of developed markets with global bonds down -1.2% over the month as yields rose to multi-year highs. The US 10-year Treasury yield pushed above 5% for the first time since 2007, driven mainly by positive economic data from the US, making it increasingly likely that rates will be ‘higher for longer’. Stocks fell across countries as the prospect of ‘higher for longer’ rates hurt equity valuations and the conflict in the Middle East dampened risk appetite. The S&P 500 Index was the best performing developed market, down -2.1% for the month, but still up 10.7% year-to-date, while in Canada the S&P/TSX Index fell -3.2%.

The NEI perspective

Conflict in the middle east has so far not had much of an impact on market performance, but has led to increased volatility through the month as investors fled to the safety of gold. Historically stock markets have shown resilience in the face of increased geopolitical risks as long as the conflicts remain locally contained.

Investors concerned about growth, as many companies saw their stocks fall following strong Q3 earnings reports. Investors were more concerned with forward guidance, with companies providing upbeat forward guidance saw price gains the day after reporting.

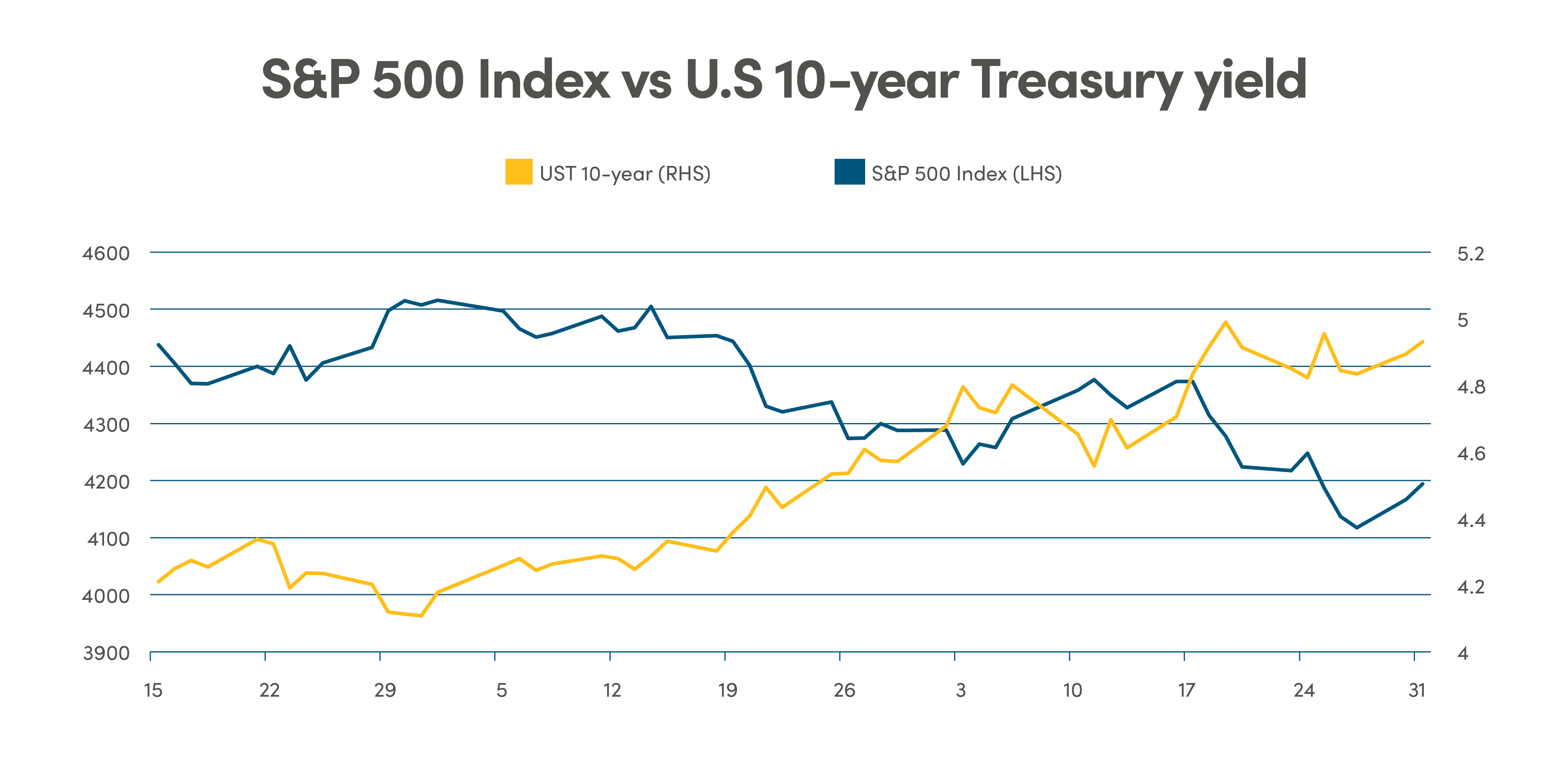

High yields continue to weight on markets with long term yields on U.S. Treasuries continuing to experience strong upward pressure. The volatility in yields have been a main driver of poor equity performance over the last two months, but higher yields may lower the need for the Federal Reserve to continue raising rates.

From NEI’s Monthly Market Monitor for October.

Canada: MSCI Canada; U.S.: MSCI USA; International markets: MSCI EAFE; Emerging markets: MSCI Emerging Markets. Source: Morningstar Direct

Canada investment grade: Bloomberg Barclays Canada Aggregate; Global investment grade: Bloomberg Barclays Global Aggregate; U.S. high yield: Bloomberg Barclays U.S. High Yield. Source: Morningstar Direct.

Q3 Earnings in focus

The U.S. is midway through the Q3 earnings season, and so far surprises have been to the upside for all sectors except energy. The quarter-over-quarter growth is remarkably strong, with both the percentage of companies and the magnitude of earnings surprises coming in above their 10-year averages. The S&P 500 is reporting positive year-over-year growth in earnings for the first time since Q3 2022 with 78% of companies beat their earnings per share estimates.

However, despite strong earnings surprises, price reaction has not been as positive as the market is increasingly focused on forward guidance. Only companies that beat expectations and gave upbeat forward guidance were rewarded. Companies that guided their growth lower were punished along with the companies that missed expectations. Although the earnings season has been encouraging, there was generally a pessimistic tone in companies’ forward guidance. Less than 30% of companies are raising their forward guidance, an early indicator of a potential slowdown of economic strength going forward.

It is still early for Canadian’s Q3 earnings season, but results have not been as rosy as in the U.S. Based on 52 (out of 226 on the TSX) companies that have reported so far, earnings growth was -3.3% quarter over quarter, despite a positive 8% overall earnings surprise. Price reaction has also been flat to negative. This may not be representative of the market until enough companies have reported by next month.

Mixed results for Tech giants

Technology stocks slid towards the end of the month after a wave of poorly received earnings reports from some of the world’s largest companies. Results from Alphabet and Meta drew the most investor scrutiny. Although both companies topped expectations on earnings, their results and commentary led to concerns about trajectory of growth in cloud and ad spending. Alphabet declined the most, despite reporting revenue and profit that topped estimates, as investors focused on lower-than-expected profitability in cloud computing, raising concerns about its position in a market critical to its future. In contrast, Microsoft’s Azure was a key driver for beating expectations. Helped by AI, it is now bigger and growing faster than Google Cloud. This was much rewarded by investors. Amazon investors also had reason to be optimistic as the CEO reported on very large orders that will be reflected in the upcoming quarter.

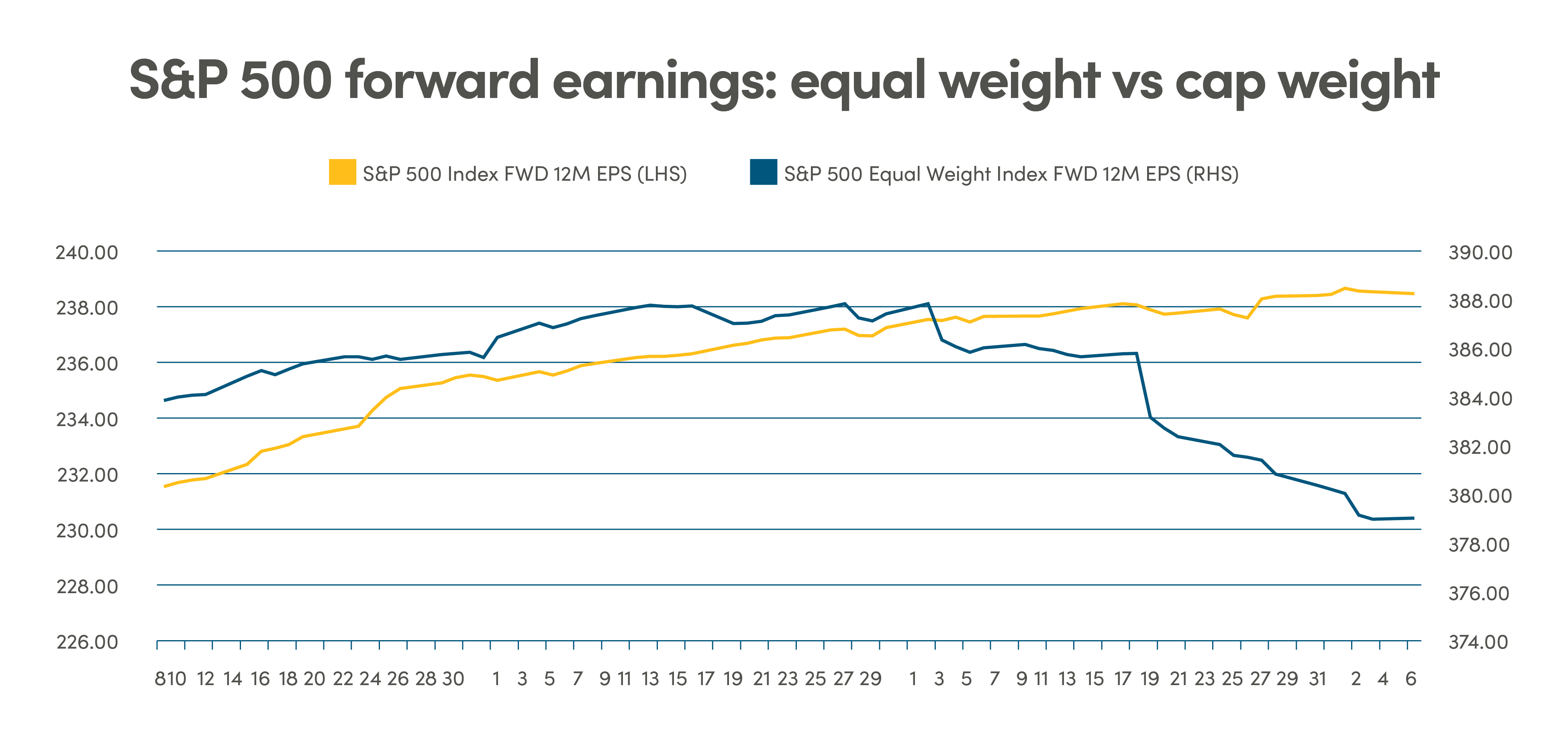

Looking at the market as a whole, on a market cap weighted basis, the earnings estimates are expected to grow over the next 12 months, while on an equal weighted basis, there is an expected decline in earnings, which indicates that for the largest companies, earnings expectations are very strong relative to the rest of the market.

Source: Bloomberg data as of October 31, 2023

The impact of rising yields on equity markets

This rise in yields as well as the rise in the volatility of yields has been the key driver of equity market movements over the last 2 months. Equities typically fare poorly when yields rise sharply. We saw a rise in yields of about 70 basis points from early September to early October, when the S&P 500 declined by about 6%, and later in October a 40 point rise when the S&P 500 declined again. When yields fell a bit in mid-October, we saw a short-lived S&P 500 rally until the rates resumed their upward movement.

Source: Source: Bloomberg data as of October 31, 2023

Canada on the brink of recession

August’s GDP data was weaker than expected, and preliminary indicators are pointing to stagnating growth in September again. These figures point to -0.1% of GDP growth in Q3, a second quarterly contraction. CD Howe Institute relies on a broader set of indicators before calling a recession, including breadth of GDP contraction and changes in employment. However, there are clear signs of softening in the labour market, with layoffs across the banking industry. Desjardins is laying off nearly 400 employees, Scotiabank is cutting 3% of its global workforce, and RBC is planning to cut 2% of its staff in the coming months. The breadth of contraction has also widened recently to approximately 60% of sectors that have contracted over the last three months.

The Canadian consumers are not as robust as in the U.S. as Canadian households have the highest debt levels amongst G7 countries driven by housing, making Canadians very sensitive and vulnerable to rise in shorter term rates. This has constrained the Canadian consumers and has negative impact on consumer driven businesses.

Canadian companies are attractively valued

Rate hikes are normally positive for banks as lenders can generate better net interest margins, however the speed of rate hikes in Canada is driving fears that businesses and highly indebted homeowners are going to default on their loans and mortgages, and rising interest rates are putting a dampener on further loan issuance. Share prices of the large Canadian banks has dropped considerably this year and are now trading at levels not seen since late 2020. Dividend yields in Canadian banks and many other Canadian companies have now risen to very attractive levels.

Legal

Aviso Wealth Inc. (“Aviso”) is the parent company of Aviso Financial Inc. (“AFI”) and Northwest & Ethical Investments L.P. (“NEI”). Aviso and Aviso Wealth are registered trademarks owned by Aviso Wealth Inc. NEI Investments is a registered trademark of NEI. Any use by AFI or NEI of an Aviso trade name or trademark is made with the consent and/or license of Aviso Wealth Inc. Aviso is a wholly-owned subsidiary of Aviso Wealth LP, which in turn is owned 50% by Desjardins Financial Holding Inc. and 50% by a limited partnership owned by the five Provincial Credit Union Centrals and The CUMIS Group Limited.

This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax or similar matters. This document is published by AFI and unless indicated otherwise, all views expressed in this document are those of AFI. The views expressed herein are subject to change without notice as markets change over time. Views expressed regarding a particular industry or market sector should not be considered an indication of trading intent of any funds managed by NEI Investments. Forward-looking statements are not guaranteed of future performance and risks and uncertainties often cause actual results to differ materially from forward-looking information or expectations. Do not place undue reliance on forward-looking information. Mutual funds and other securities are offered through Aviso Financial Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual fund securities and cash balances are not insured nor guaranteed, their values change frequently and past performance may not be repeated.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to computing, computing or creating any MCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages.