August 2025 Monthly Market Insights

August 2025 Monthly Market Insights

Data and opinions as of July 31, 2025

Markets at highs, policy in flux

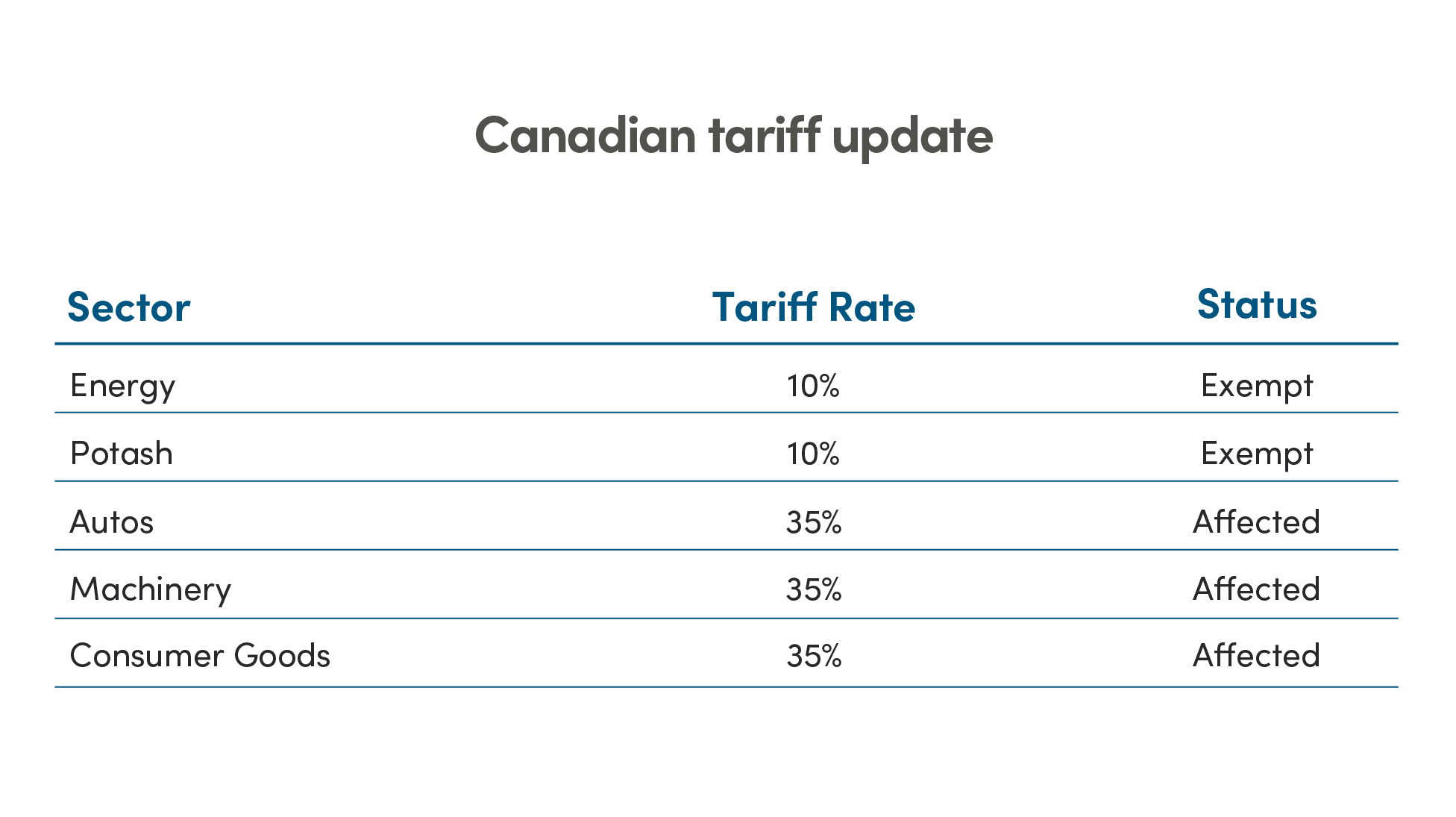

Markets reached new highs in July, but beneath the surface, concentration risk and valuation concerns are growing—especially in the U.S., where the top 10 stocks now dominate index performance. Diversification across regions and sectors remains essential. Meanwhile, the Fed held rates steady, but political pressure and stronger- than-expected economic data have clouded the outlook. A dovish pivot seemed likely until late-month surprises— including robust GDP and jobs numbers—prompted markets to reassess. Equity indices pulled back, and yields rose, reflecting renewed uncertainty. On the trade front, Canada faces a 35% tariff on non-CUSMA goods starting August 1, yet markets have responded with surprising calm. While energy and potash are exempt, other sectors may feel the pinch in Q3. Overall, the environment remains supportive but fragile. Advisors should emphasize flexibility, diversification, and a long-term view as policy, politics, and pricing continue to evolve.

NEI perspectives

Markets at all-time highs—stay diversified: Equity markets continued to climb in July, but leadership remains narrow and valuations are stretched—especially in the U.S. Bottom line: Don’t let record highs deter disciplined investing. Diversify across regions and sectors to manage risk.

The Federal Reserve (Fed) holds steady, but uncertainty rises: The Fed kept rates unchanged, but late- month economic surprises and political pressure have clouded the outlook. Bottom line: A less hawkish Fed supports markets, but recent data has rattled rate-cut expectations.

Stay flexible. Tariff risks persist, but markets stay calm: Canada faces a 35% tariff on non-CUSMA goods starting August 1, yet markets have remained resilient. Bottom line: Tariffs are back in focus. Watch for sector-specific impacts, especially in manufacturing and retail.

‒ NEI Asset Allocation team

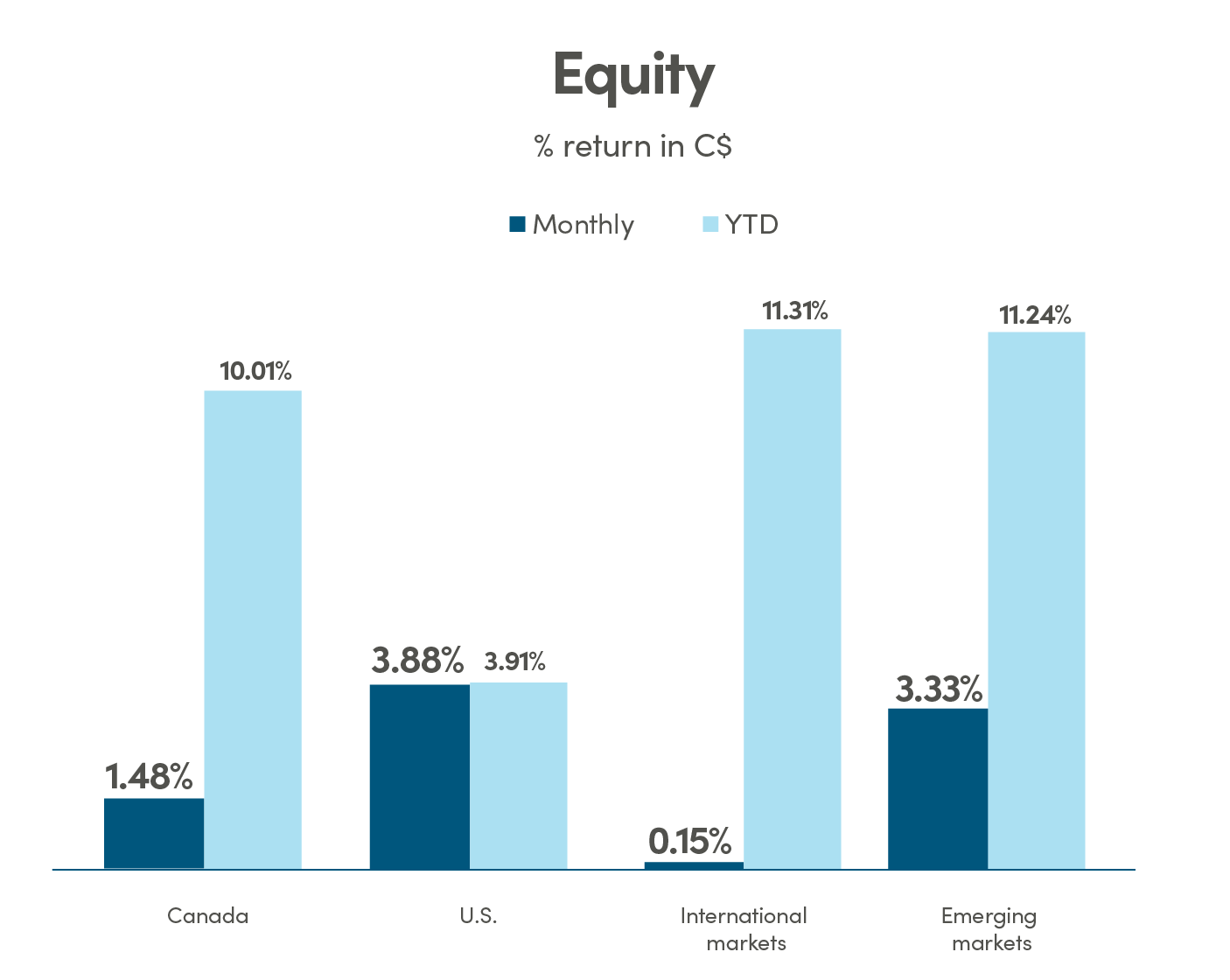

Canada: MSCI Canada Index TR; U.S.: MSCI USA Index TR International: MSCIEAFE Index TR; Emerging markets: MSCI Emerging Markets Index TR.

Source: Morningstar Direct.

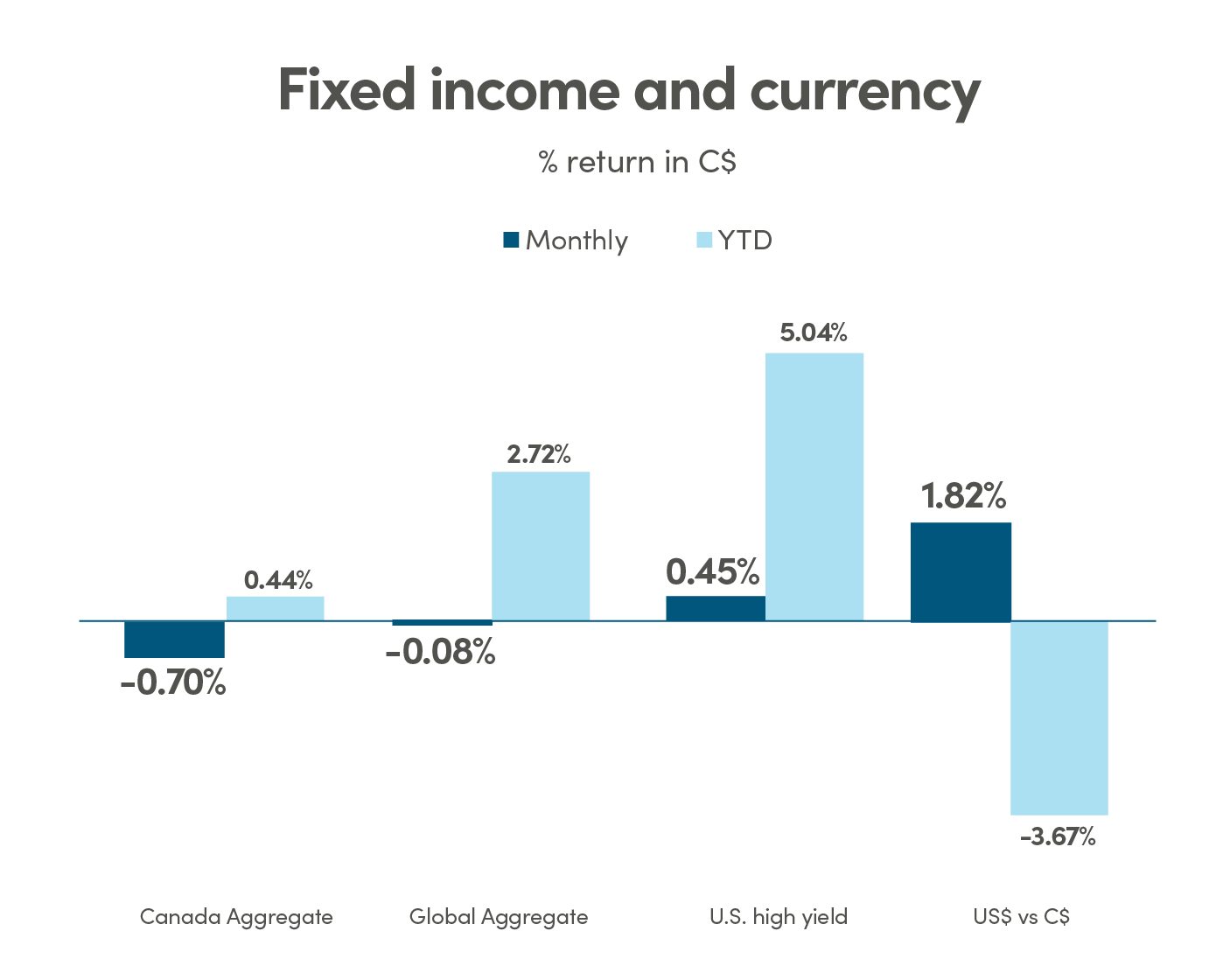

Canada Aggregate: Bloomberg Barclays Canada Aggregate Bond Index; Global Aggregate: Bloomberg Barclays Global Aggregate Bond Index; U.S. High Yield: Bloomberg Barclays U.S. High Yield Index.

Source: Morningstar Direct.

Investing at all-time highs: why diversification matters

Markets reached new highs in July, with the S&P 500 and MSCI World Index continuing their upward momentum. While this can trigger investor hesitation, historical data shows that investing at all-time highs has often led to positive returns—over 80% of the time over the past three decades. The real concern isn’t the level of the market, but its composition. In the U.S., the top 10 stocks now account for over 35% of the S&P 500’s market cap, a level not seen since the early 2000s. These names—mostly tech giants—carry elevated valuations and dominate performance, raising concentration risk.

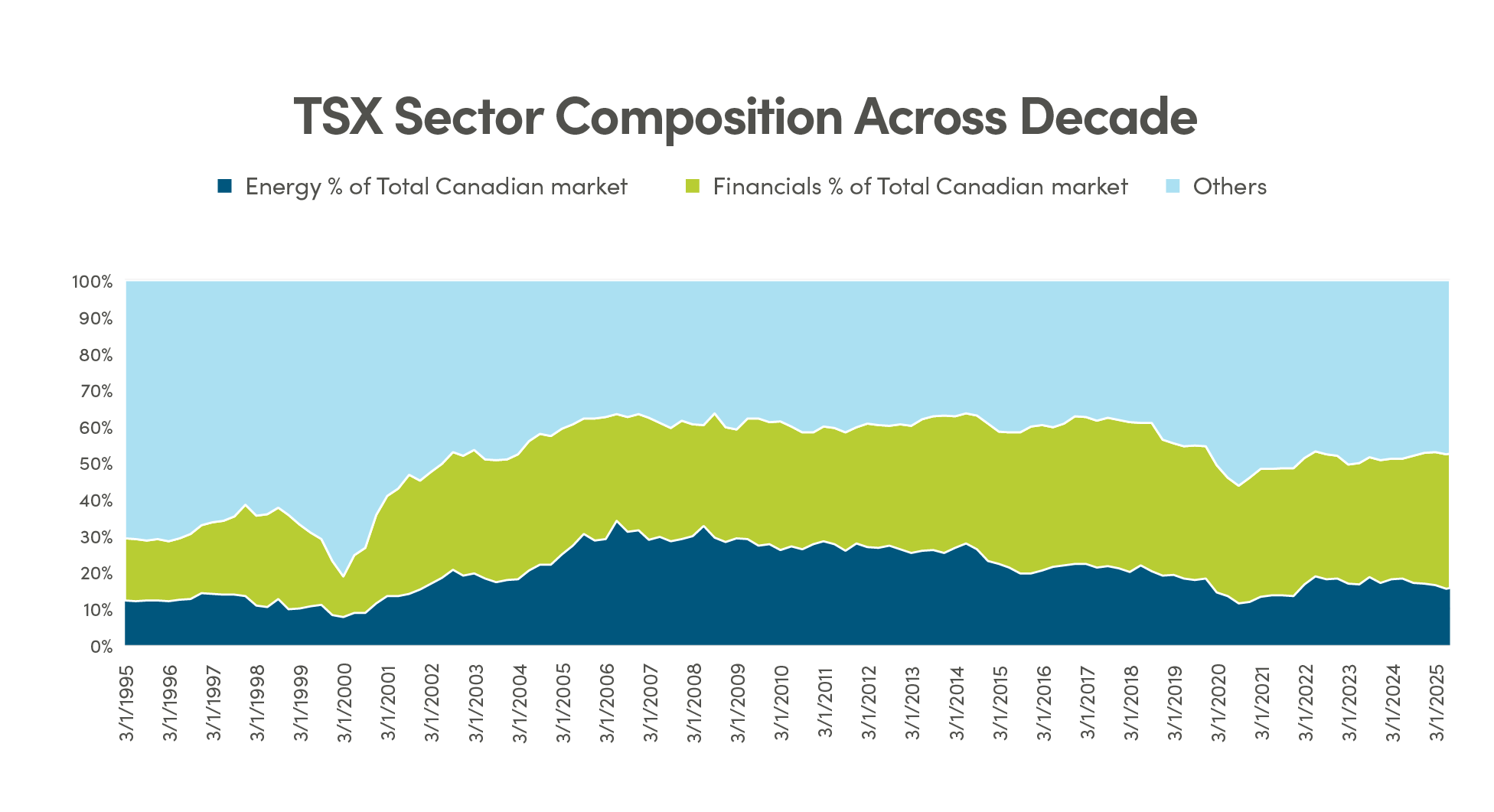

International markets offer a compelling contrast. Europe and Japan present more balanced sector exposure and trade at significantly lower valuations. For example, MSCI Europe’s forward P/E is around 13.2, compared to 20.1 for the U.S. Meanwhile, sector leadership continues to evolve. Canada’s index, once dominated by energy, now sees financials and tech playing a larger role. This shift underscores the importance of diversification—not just across asset classes, but across geographies and sectors.

Source: Bloomberg

Bottom line: Market highs aren’t a signal to retreat—they’re a reminder to stay diversified. A globally balanced portfolio helps manage risk and capture opportunity, especially when leadership is narrow and valuations are elevated.

Cooling inflation, political pressure, and a cautious Fed

The Fed held rates steady at 4.25%–4.50% in July, but the decision came with growing tension. Chair Powell maintained a cautious tone, citing sticky services inflation and uncertainty around the impact of recent tariffs. Meanwhile, two Fed governors dissented in favor of a rate cut—the first dual dissent in decades—reflecting political pressure from former President Trump, who has called for lower rates to ease the $1 trillion interest burden on the government’s debt.

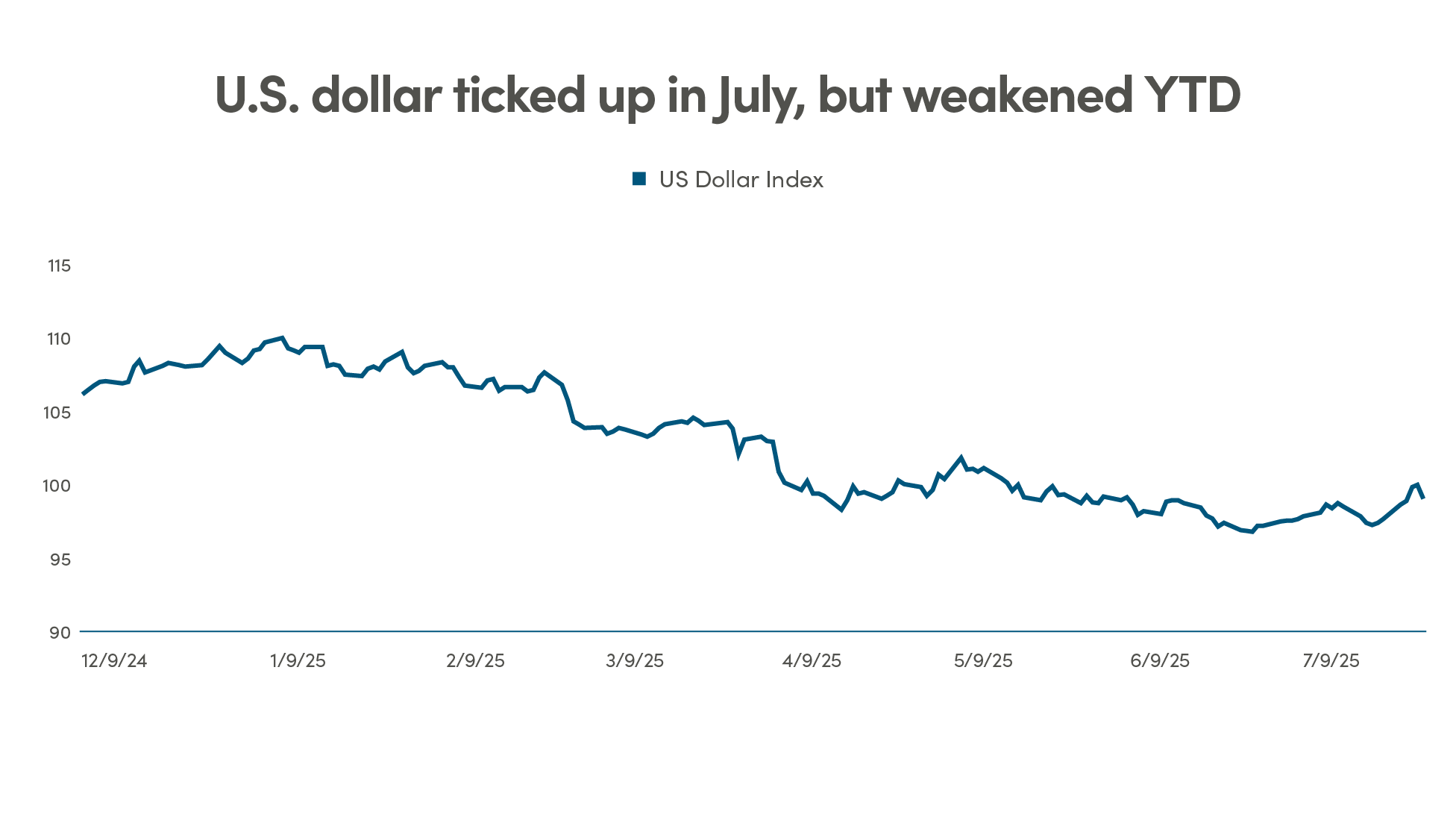

Initially, markets interpreted the Fed’s stance as supportive. But sentiment shifted dramatically in the final days of July. Stronger-than-expected Q2 GDP growth (3% annualized) and firmer inflation readings conflicted with negative revisions and a much weaker than expected jobs report on August 1, which raised the likelihood of rate cuts in September. Equity markets pulled back, Treasury yields fell, and the U.S. dollar weakened, reflecting renewed uncertainty about the Fed’s path forward.

Source: Bloomberg

Bottom line: While inflation is cooling and political pressure is mounting, the Fed remains cautious. Recent economic surprises have rattled markets, reminding investors that rate expectations can shift quickly. Advisors should emphasize flexibility and risk management in portfolio strategy.

Tariff tensions: muted reaction, lingering risks

On August 1, the U.S. imposed a 35% tariff on Canadian goods not covered by CUSMA. While key exports like energy and potash are exempt, sectors such as autos, machinery, and consumer goods are directly affected. Europe, by contrast, secured extensions and lower rates, avoiding the brunt of the tariff wave. Despite the headline risk, markets have responded with surprising calm. The Canadian dollar held steady, and equity indices showed little reaction.

This muted response may reflect the fact that many companies had already adjusted supply chains earlier in the year. However, the long-term impact could still be felt in corporate margins and pricing, particularly in manufacturing and retail. Canada’s government is reviewing potential countermeasures, but for now, the focus remains on monitoring sector-level fallout.

Source: Bloomberg

Bottom line: Tariffs haven’t triggered broad market volatility, but risks remain under the surface. Advisors should stay alert to earnings impacts and supply chain disruptions, especially in trade-sensitive industries.

Legal

Aviso Wealth Inc. (“Aviso”) is the parent company of Aviso Financial Inc. (“AFI”) and Northwest & Ethical Investments L.P. (“NEI”). Aviso and Aviso Wealth are registered trademarks owned by Aviso Wealth Inc. NEI Investments is a registered trademark of NEI. Any use by AFI or NEI of an Aviso trade name or trademark is made with the consent and/or license of Aviso Wealth Inc. Aviso is a wholly-owned subsidiary of Aviso Wealth LP, which in turn is owned 50% by Desjardins Financial Holding Inc. and 50% by a limited partnership owned by the five Provincial Credit Union Centrals and The CUMIS Group Limited.

This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax or similar matters. This document is published by AFI and unless indicated otherwise, all views expressed in this document are those of AFI. The views expressed herein are subject to change without notice as markets change over time. Views expressed regarding a particular industry or market sector should not be considered an indication of trading intent of any funds managed by NEI Investments. Forward-looking statements are not guaranteed of future performance and risks and uncertainties often cause actual results to differ materially from forward-looking information or expectations. Do not place undue reliance on forward-looking information.

Mutual funds and other securities are offered through Aviso Financial Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual fund securities and cash balances are not insured nor guaranteed, their values change frequently and past performance may not be repeated.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to computing, computing or creating any MCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages.

©2025 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar Research Services LLC, Morningstar, Inc. and/or their content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar Research Services, Morningstar nor their content providers are responsible for any damages or losses arising from any use of this information. Access to or use of the information contained herein does not establish an advisory or fiduciary relationship with Morningstar Research Services, Morningstar, Inc. or their content providers. Past performance is no guarantee of future results.