3-year Raise the Rate GIC

3-YEAR RAISE THE RATE GIC

A GIC like no other. Now you have the power to raise your rate. Available for non-registered, RRSP, TFSA, and RRIF accounts.

Low minimum

Start investing for as little as $100

Guaranteed returns

Both your initial investment and your return are guaranteed.

No locked in rates

Start with a competitive rate. If our rates go up, you can “rate match” and increase your return.

Non registered investment

Tax Free Savings Account

Registered Retirement Savings Plan

How it works

Rates and rate-match options

Purchase a 3-year Raise the Rate GIC at the current, competitive rate. If interest rates on comparable Meridian GICs increase, you can increase the rate on your GIC. Raise your rate online, at any Meridian branch, or by calling the Contact Centre.

| 3-year GIC | 3.35% |

| 3-year TFSA GIC | 3.35% |

| 3-year RRSP GIC | 3.35% |

|

Rate match against an applicable Meridian GIC once over the course of your 3-year term. Applicable GICs include:

|

|

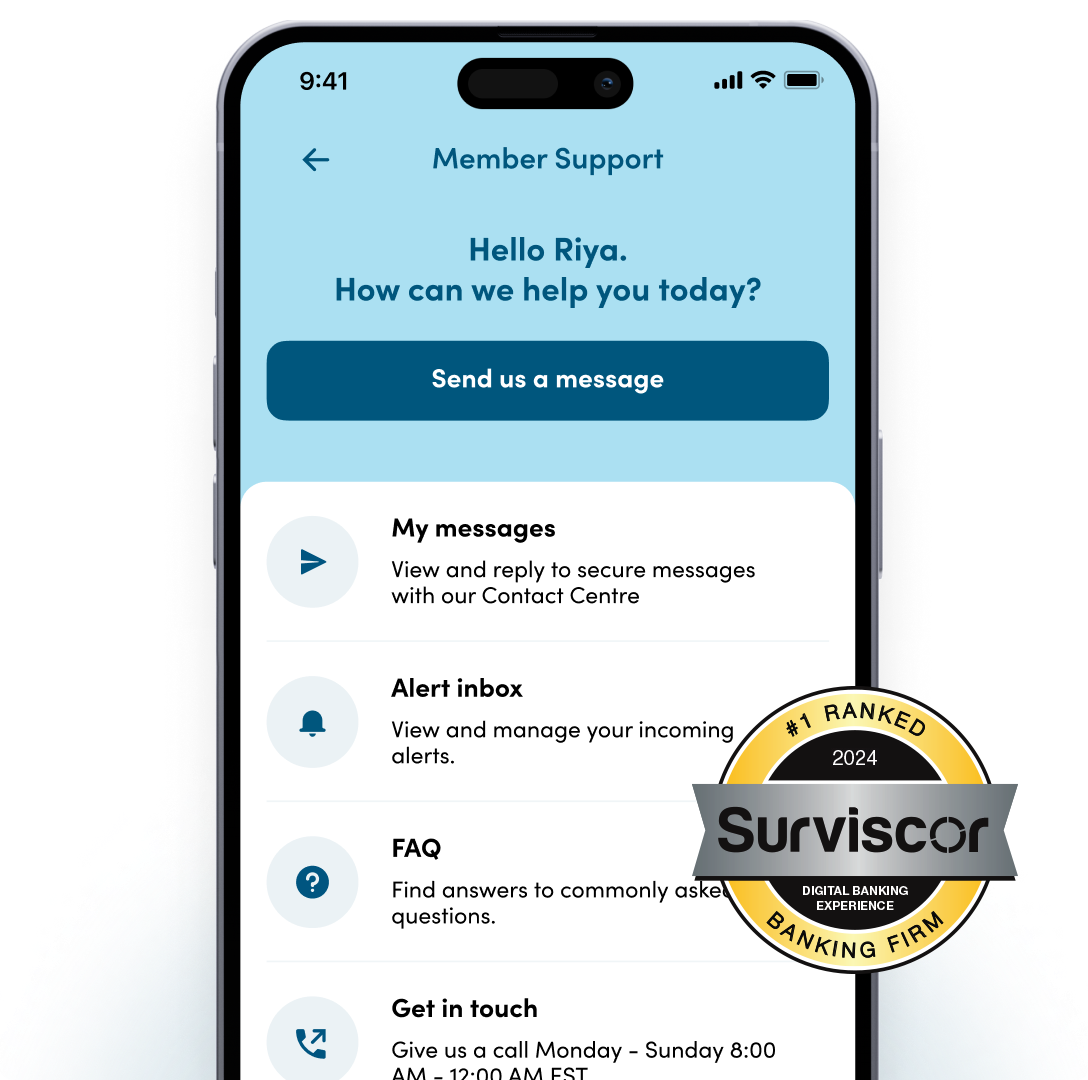

Open in the app

Open your GIC investments easily, right in the mobile app.

Go paperless

Keep track of your account activity with monthly eStatements

Member benefits

Explore the app and discover what Meridian has to offer Members.

Around here, opening a GIC investment is simple

1

Complete your Member application online

2

Sign in using online banking or the mobile app

3

Fund your investment using one of the available options