Understanding mortgage interest rates

The impact of interest rates on home ownership

Interest rates make the news every day. A change to this one. A prediction about that one. Why does it matter and why are so many people interested in the minor ups and downs of interest rates?

When you take out a mortgage, you agree to pay back the entire amount you borrowed (the principal amount) plus interest for the entire life of the mortgage. Over the typical lifespan of a mortgage (25 years is the most common), the total amount of interest, along with any fees you pay, is called, “The cost of borrowing”. The goal is to keep your cost of borrowing as low as possible over the life of your mortgage, so you can enjoy the benefits of home ownership without spending more than you need to.

If you know how much you plan to borrow, you can experiment with various rates to see how they affect your monthly payments with our easy-to-use mortgage payment calculator.

How does interest get paid?

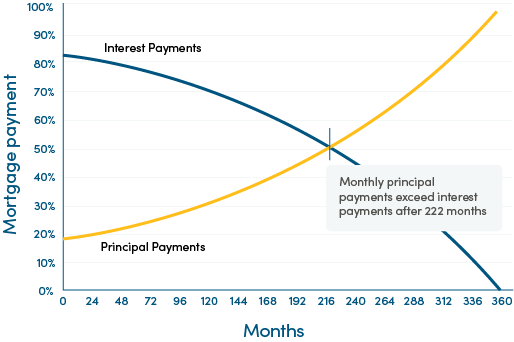

Every payment you make on your mortgage gets divided into two parts. One part pays down the interest and the other pays down the principal. In the early days of having a mortgage, a larger portion of your payment goes toward paying the interest. As you pay down your mortgage, that shifts and in the final years, most of your payment goes to the principal amount.

How are interest rates set?

The most important interest rate in Canada is the one set by the Bank of Canada (BoC). It’s called the prime rate. All financial institutions use the BoC prime rate as a starting point to set their own lending rates. From there, your interest rate is calculated using all the credit factors included in the approval process.

Why do rates go up and down?

Interest rates are one of the many ways the federal government can encourage or discourage spending. It’s difficult to estimate when rates will change. But when you get a mortgage, it’s important to understand where they are and if there is any sign they may change. For example, home buyers on a very tight budget may worry about slight increases in interest rates. Others may see some fluctuation as an advantage. That’s why we offer both fixed and variable-rate mortgages and help you choose the one that’s right for you.

Beyond rates. What else matters when you shop for a mortgage.

Every good mortgage provides options for paying down your principal amount faster. Taking advantage of these flexible features may have a greater impact on your cost of borrowing than simply choosing the lowest interest rate.

Here’s an overview:

| Feature | What it means for you |

|---|---|

| Fixed-rate mortgage option | Stability: Your interest rate is locked in (fixed) and won’t change regardless of changes to the Meridian prime rate. Your payments and payment schedule are predictable - your rate won’t go up if interest rates do. |

| Variable-rate mortgage option | Flexibility: Your rate is tied to the Meridian prime rate and fluctuates with it. When rates are high more of your money goes to paying off interest. But when rates are low, more of your payment goes to the principal portion of your mortgage to lower your cost of borrowing. |

| Convertibility | Whether you choose a fixed- or variable-rate mortgage, you can convert one to the other if interest changes. Some conditions apply, but Meridian Mortgage Specialists are always happy to help you choose the right option. |

| Mortgage term | The mortgage term you select will likely affect the interest rate you pay. Generally, the longer the term, the higher the rate. Our mortgages can be anywhere from 6 months to 10 years. Experiment with mortgage types and terms on our easy-to-use mortgage payment calculator. |

| Mortgage frequency | You can choose to pay your mortgage at different frequencies: monthly, semi-monthly, bi-weekly, accelerated bi-weekly, weekly or accelerated weekly. Simply changing the frequency of your mortgage could make you mortgage-free years ahead of schedule. |

| Lump-sum payments | You can make lump-sum payments that go directly to the principal portion of your mortgage. One lump-sum payment a year can lower your cost of borrowing and could help you pay off your mortgage sooner. |

| 20/20 prepayment option | Pay off up to 20% more of your mortgage each year through a combination of prepaying more of your original principal balance and increasing your original mortgage payment. |

| Amortization period | Most first-time mortgages give you 25 years to pay off the total amount, but this can be adjusted. Changing your amortization period affects how quickly you pay off your mortgage. |

As you can see, there’s more to a great mortgage than just the interest rate. Flexible features that let you pay off your mortgage faster, for less, can be just as valuable. Get the whole picture from a Mortgage Specialist at Meridian today. And because we are provincially regulated, we have extra flexibility to create personalized mortgage solutions for our Members.

Questions? There are several ways to get in touch