High ratio mortgage

HIGH RATIO MORTGAGES

With a high ratio1 mortgage, you can buy a home even if you don’t have 20% to put down. It’s a great option for first-time buyers.

A high ratio mortgage could be the right choice if:

- You’re a first time home buyer.

- You have a down payment that is less than 20% of the purchase price.

- You’re comfortable with the extra costs associated with mortgage default insurance.

A high ratio mortgage might not be for you if:

- You have a larger down payment that is more than 20% of the purchase price.

- You plan to purchase a high-priced home that exceeds the threshold for insurable mortgages.

- You want to avoid the extra costs associated with mortgage default insurance.

Be mortgage free sooner

We call it 20/20 prepayment. Pay off up to 20% more of your mortgage each calendar year through a combination of prepaying more of your original principal balance and increasing your original mortgage payment.

Skip a payment

Life happens. Breathe easier knowing that you can skip one month’s mortgage payment once every 12 months with no penalty.

Payment flexibility

Choose from weekly, bi-weekly, monthly, bi-monthly, or accelerated weekly or bi-weekly payment plans - whatever works for you.

Meridian mortgage eligibility

- You’re a Canadian citizen or a permanent resident.

- You’re over 18 years of age.

- You consent to a full credit check.

- You can provide personal information, income, and asset details.

- If self-employed, your business has been operating more than two years.

Mortgage protection

Take advantage of Group Mortgage Protection (GMP) - a monthly premium that helps safeguard your home in case of financial hardships as a result of conditions such as death, disability, critical illness or loss of employment.

This creditor group insurance coverage is optional and is underwritten by The Canada Life Assurance Company (Canada Life). Supporting services, such as enrollment intake, medical underwriting and claims administration are provided by the employees of Canada Life. Coverage is governed by the terms and conditions of the creditor group insurance policy issued to the creditor and is subject to terms, conditions, exclusions and eligibility requirements. See the Certificate of Insurance for full coverage details.

Secure your rate

Around here, we’ll hold your rate for up to 120 days

Complete your Meridian mortgage application and we’ll hold your rate while you search for your new home. That gives you 120 days without having to worry about rates changing. No commitment or obligation.

Mortgage terms

Choose from a range of flexible terms

| Amortization | Maximum of 25 years |

|---|---|

| Terms | 3 or 5-year fixed or 5-year variable |

| Payment Frequency | Weekly or accelerated weekly, bi-weekly or accelerated bi-weekly, monthly, or bi-monthly |

When you get a high ratio mortgage you also need to get mortgage default insurance. Learn more about mortgage insurance.

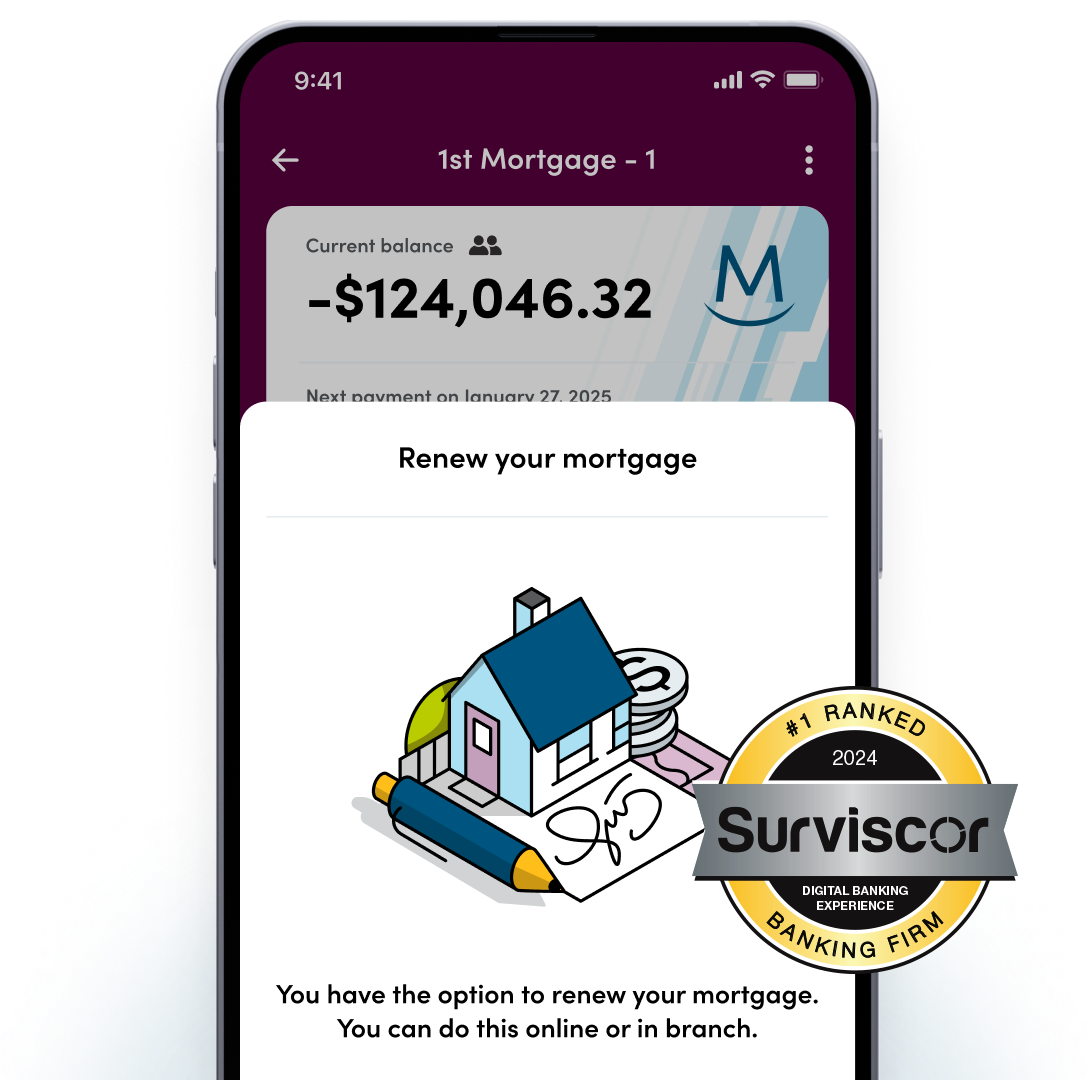

Renew your mortgage

Choose a new term and secure your rate at renewal.

Support when you need it

Questions? Send a secure message right inside the app.

Manage your payments

Change your payment schedule to suit your needs.

Around here, starting your mortgage journey is simple

1

Start your Member application online

2

Complete the forms and secure your personalized rate

3

We’ll confirm your approval details