Check your credit score

Check your credit score

FICO® Score is free for Members with at least one Meridian borrowing product.

What is a FICO® Score?

A FICO Score is a 3-digit number that is based on credit reports from agencies like TransUnion and Equifax. The score helps lenders, like Meridian, determine credit risk and predict how likely you are to pay back what you borrow. Build your financial confidence by understanding your credit score and how it impacts your ability to borrow.

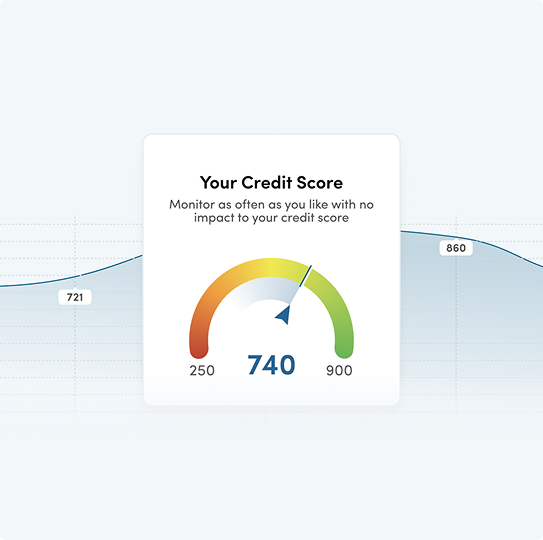

Your credit score

Find out where you stand. Monitor your credit for free, anytime, with no impact on your credit score.

Score history

Your score history is updated quarterly and helps you determine how you’re progressing over time.

Key factors

Discover the factors affecting your score, what they mean, and what you can do to make improvements.

Your credit score

Understanding your credit score matters

Your credit score affects your ability to borrow, which can impact your overall financial well-being. Maintaining a good credit score can make it easier to borrow and improve your chances of getting a good interest rate.

How to check your FICO® Score

Step 1

Sign in to Meridian Online banking

Step 2

Select "Your credit score" from the Account Summary screen

Step 3

Select "Show score" to reveal your most recent FICO® Score

Scores are updated quarterly, so check back regularly to see how your score changes over time. Regular monitoring will not impact your credit score.

Step 1

Sign in using the Meridian mobile banking app

Step 2

Switch to the “Dashboard” tab from your home screen

Step 3

Select "Show score" to reveal your most recent FICO® Score

Frequently asked questions about credit and FICO© Scores

Scores generally range from 300 to 900, where higher scores indicate lower credit risk, and lower scores indicate higher credit risk.

When it comes to credit applications, individual lenders have their own standards, but here is a general guide to score ranges and what they mean.

-

300–579: Poor – well below average, lenders consider this borrower risky.

-

580–669: Fair – below average, some lenders will approve credit with this score.

-

670–739: Good – near average, most lenders consider this score good.

-

740–799: Very Good – above average, lenders consider this borrower very dependable.

-

800–900: Exceptional – well above average, lenders consider this borrower exceptional.

Meridian Members with at least one lending product* can access their free FICO Score in Meridian online or mobile banking. Qualifying products include loans, lines of credit, mortgages, credit cards, and overdraft facilities.

*Must be active. Closed accounts or credit facilities do not qualify.

No. You can check your credit reports and FICO® Scores as often as you'd like, it will not lower your scores.

FICO® Scores are calculated from the credit data in your credit report. This data is grouped into the five following categories:

-

Payment History - About 35% of a FICO® Score is based on payment information on many types of accounts (for example: credit cards, retail accounts, loans etc.). Making timely payments is one of the most important ways to maintain a good credit rating and the largest factor in determining your score.

-

Amounts Owed - The amount you owe, or “credit utilization” has a big impact on your score as well. Approximately 30% of a FICO® Score is based on this information. It considers the amount you owe compared to how much credit you have available.

-

Length of Credit History - Approximately 15% of a FICO® Score is based on the length of your credit history. Generally, a longer credit history will increase a FICO® Score. However, even if you’re new to borrowing you can get a good FICO® Score. It depends on what your credit report says about your payment history and amounts owed.

-

New Credit - New credit accounts for about 10% of a FICO® Score. Opening several credit accounts in a short period represents greater risk, especially for people who do not have a long credit history.

-

Credit Mix (types of credit) - The mix of credit types (loans, credit cards, retail accounts, etc.) accounts for about 10% of a FICO® Score. It’s not necessary to have one of each, and it is not a good idea to open a credit account you don't intend to use.

Get more info on understanding your credit score

Late payments have the largest impact on your score. Your credit score factors in late payments in a few ways, including how recent the late payments are, how severe the late payments are, and how frequently the late payments occur. This means that a recent delinquency could be more damaging than several late payments that happened a long time ago.

Typically, creditors report late payments in one of these categories: 30-days late, 60-days late, 90-days late, 120-days late, 150-days late, or charge-off. While a 90-day late is worse than a 30-day late, the important thing to understand is that people who continually pay their bills on time tend to appear less risky.

There are a few ways to establish a credit history.

-

Apply for and open a new credit card account. With no or little credit history, you might not get the best terms or rate, but by charging small amounts and paying off the balance each month, you may avoid paying interest while establishing solid payment history.

-

If you can’t get approved for a traditional credit card, you might be able to open a secured credit card to build a credit history. This type of card requires a deposit to “secure” the funds and you can usually borrow up to the amount deposited.

With both traditional and secured credit cards, you can build a good credit history by keeping a low balance and paying it off every month.

There are a few ways to improve your credit score.

-

Pay your bills on time. Delinquent payments and collections can have a major negative impact on your FICO® Scores. If you're behind on payments, get current and stay current.

-

Avoid collections. Paying off a collection account will not remove it from your credit report. It will stay on your report for seven years.

-

Keep balances low. It's okay to use your credit cards, just be careful about using a large percentage of your available credit — high utilization rates can have a major impact on your FICO® Scores.

-

Do your rate shopping within a short period of time. FICO® Scores distinguish between a search for a single loan and a search for a mortgage, student, or auto loan, in part by the length of time over which inquiries occur.

-

Have credit and manage it responsibly. Ultimately, having a mixture of credit is a good thing — as long as you make your payments regularly and on time. Someone with no credit cards tends to be higher risk than someone who has managed credit cards responsibly.

-

Don't close unused credit cards to raise your scores. Your FICO® Scores consider the age of your accounts — the longer your credit history, the better.

When you apply for credit, you authorize those lenders to ask or "inquire" for a copy of your credit report from a consumer reporting agency. When you later check your credit report, you may notice that their credit inquiries are listed. You may also see inquiries by businesses that you don't know. But the only inquiries that count toward your FICO® Scores are the ones that result from your applications for new credit.

-

Soft inquiry. Soft inquiries are all credit inquiries where your credit is NOT being reviewed by a prospective lender. FICO® Scores do not consider involuntary (soft) inquiries made by businesses with which you did not apply for credit, inquiries from employers, inquiries from lenders for account review purposes for which you already have a credit account, or your own requests to see your credit file.

-

Hard inquiry. Hard inquiries include credit checks when you've applied for an auto loan, mortgage, credit card or other types of loans. Each of these types of credit checks count as a single inquiry. One exception occurs when you are "rate shopping". Your FICO® Scores consider all hard inquiries within a reasonable shopping period for an auto, student loan or mortgage as a single inquiry.

There are many different credit scores available to consumers and lenders. FICO® Scores are the credit scores used by most lenders, and different lenders may use different versions of FICO® Scores. In addition, FICO® Scores are based on credit file data from a consumer reporting agency, so differences in your credit files may create differences in your FICO® Scores.

Learn more about borrowing options

Personal loans

Line of credit

Garden and laneway homes

Mortgage advice