Visa Infinite* Cash Back Card

VISA INFINITE* CASH BACK CARD

No annual fee for the first year, including on additional cards†

4% Gas and groceries

Earn 4 reward points for every $1 spent on gas and groceries˄

2% Pharmacy and utility bills

Earn 2 reward points for every $1 spent on pharmacy and utility bill payments˄

1% Other eligible purchases

Earn 1 reward point for every $1 spent on other eligible purchases

Earn rewards simply for making every day purchase. To check your points balance or redeem points, access eZCard via Meridian online banking. Redeem your cash back rewards1 the way you want. Options include:

The Meridian Visa Infinite Cash back card comes with a full suite of insurance and services that delivers an extra layer of protection and reassurance when travelling. For insurance-related questions, contact Assurant: 1-800-316-7645 from Canada and the United States or 613-634-6984 locally or collect from other countries.

†View the Certificate of Insurance and Statement of Services (PDF, 430 KB)

Coverage of up to $5,000,000 per insured person per trip for eligible medical care and services required, including transportation, repatriation, living expenses and dental care. Duration of coverage for each trip is dependent on the insured’s age, up to a maximum age of 75, and for up to 48 days.

Up to $2,000 of coverage per person if the trip is cancelled prior to departure for a covered cause. In the event of trip interruption/delay after departure coverage is for up to $2,000 for missed connections and unlimited coverage if due to illness or accident.

Coverage of up to $500 per person per trip for replacement of essential items in the event of delayed baggage and up to $1,000 per person per trip in the event of loss, theft or damage to checked baggage.

Up to $1,000,000 of coverage per person in the event of the accidental death or injury of you, your spouse or eligible children while passengers on a common carrier (air, sea or ground).

Coverage for rental periods of up to 48 consecutive days in the event your rental vehicle is damaged or stolen when you charge the full cost of your rental to your card and decline the rental agency’s collision/loss damage waiver.

Coverage of up to $1,000 in the event your cell phone, smartphone or tablet is lost, stolen, accidentally damaged or experiences mechanical breakdown.

Provides coverage for 90 days from the purchase date in the event of loss, theft or damage when you purchase eligible items with your card. Maximum of $10,000 per item up to a maximum of $50,000 lifetime per account.

Coverage automatically doubles the original manufacturer’s warranty for up to a maximum of one additional year for eligible items purchased with your card. Maximum of $10,000 per item up to a maximum of $50,000 lifetime per account.

Anywhere in the world at any time 24/7 Travel Assistance is there to help.

Reimbursement of the price difference if a new eligible item purchased with your card is found advertised at a lower price in Canada within 60 days of purchase, up to $100 per item and $500 per account per year.

Fees

Fees, rates, and eligibility

| Annual fee | $99 |

|---|---|

| Additional cards | $30 |

| Purchase rate | 19.50% |

| Cash advance rate | 21.99% |

| Additional eligibility requirements | $60,000 personal or $100,000 household income |

View rewards

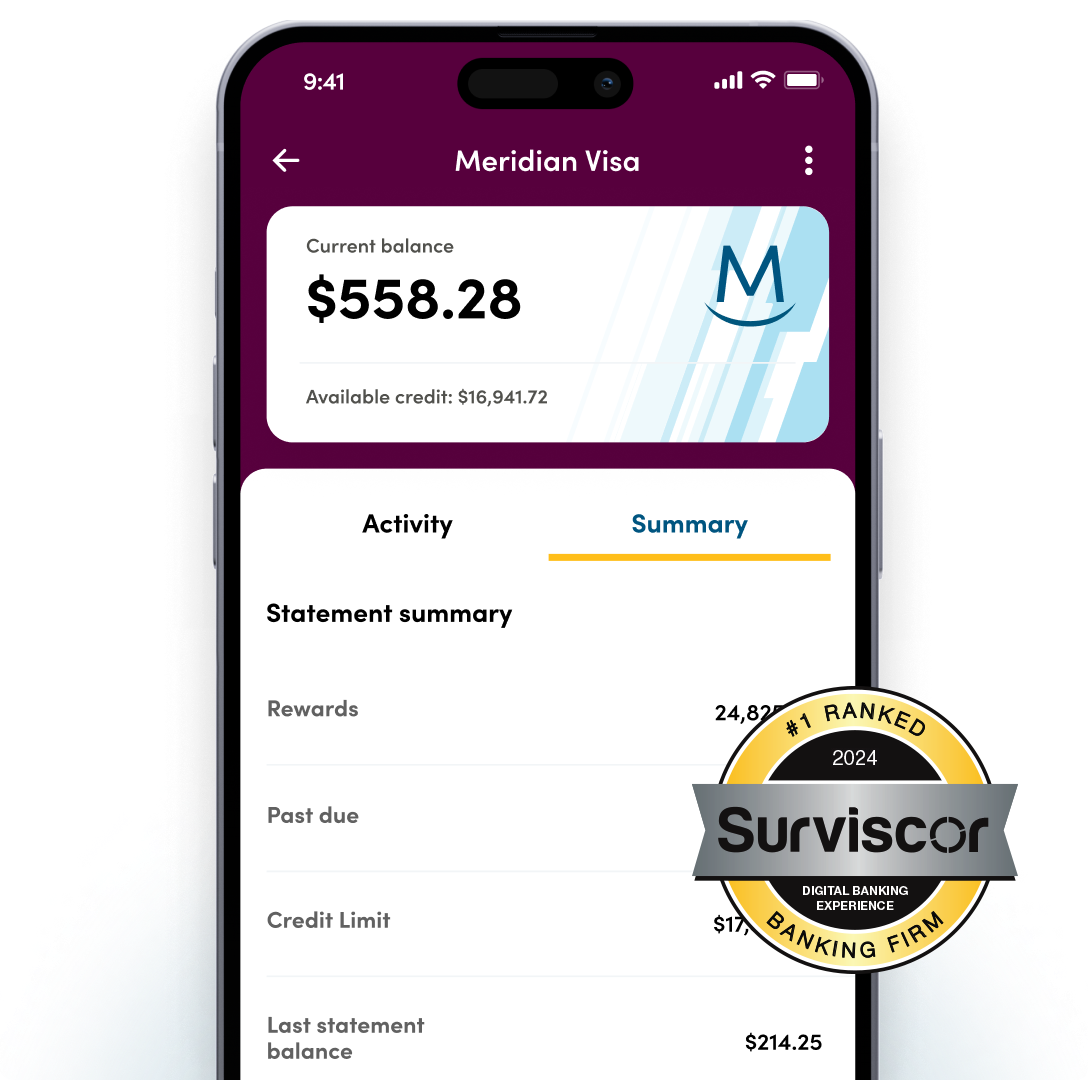

Check your rewards balance in online and mobile banking.

Alerts

Keep track of your accounts with transaction, security, and balance alerts.

Virtual card

Easily add your new Meridian credit card to your digital wallet.

Around here, applying for your Meridian Visa Card is simple

1

Select “Apply Now' to start your application

2

Follow the prompts to complete the application

3

We’ll confirm once you’re approved

Cardholder Services

Our Cardholder Services team is available 24 hours a day, 7 days a week. Call us at 1-877-558-3049.

Terms and conditions

Meridian Visa Infinite Cash Back Card Disclosure Statement and Cardholder Agreement available for review.

Membership with Meridian Credit Union is a regulatory requirement to hold a Meridian Visa. You are not required to have other Meridian Credit Union products.