How to save money

A clear saving plan is worth more than money in your account – it can improve your confidence and overall sense of well-being. A happy relationship with your money can make for a happier (and healthier) you.

How to start a saving plan

A savings plan includes your budget, your savings goals, and how you plan to add to your savings.

Create a budget

Figure out where your money goes every month by calculating your income and expenses. Knowing how you spend is key to learning to save.

Set a goal

What are you saving for and when will you need the money? Figure out how much you need to save, and how quickly, for your long- and short-term goals.

Pay yourself

Automated transfers to your savings account help you build savings faster. Transfer a set amount every two weeks or every month. Even if you start small, it makes a difference.

Money saving tips

Get creative about spending less. Once your budget helps you understand what you’re spending, you’ll find that there are lots of ways to cut back. Even little things like coffees, take-out lunches, and other non-essentials can really add up. Here are seven quick tips to get you started.

1. Tally up your budget

Go through all the things you spend money on and make lists: things you need and things you want. Needs would include essentials like groceries, transportation costs ( like gas or transit fare), health care, phone, internet, etc. Wants are things like dinner at a restaurant, concert tickets, your Netflix subscription, vacation costs, etc. Ideally, you spend 50% of your income on the things you need, maximum 30% on the things you want, and set aside the remaining 20% as savings.

2. Regulate your online shopping

The internet makes shopping so easy - too easy, sometimes. Targeted ads, shopping links all over social media - the opportunity to spend is everywhere. That’s why it’s a good idea to create some strategies for cutting your online spending. For example, many people take a break before purchasing. If you have items in your online shopping cart, just leave them there for a while. This gives you time to think about whether you really want to spend your money – whether it’s 30 minutes, 24 hours, or 30 days.

3. Cut down subscriptions

Make a list of all the services you subscribe to, like Amazon Prime, Apple TV, Spotify, etc. Which ones do you use the most? Once you have a full list you may find that you’re not getting your money’s worth from one or more of your subscriptions. You could save quite a bit of money by getting rid of anything you don’t use or enjoy enough.

4. Pay off high interest debt

Carrying high-interest debt (like outstanding credit card balances) can really cut into your budget. If you can prioritize paying this off sooner you’ll have more money available to set aside as savings and pay off lower interest debt.

5. Earn more interest on savings

Setting your money aside for future goals is good. Putting it in a high-interest account where it can earn you more money is better. For example, Meridian’s High Interest Savings Account helps you grow your savings with more interest than many other banks. You can also use a TFSA (Tax Free Saving Account). Talk to an advisor about your best option.

6. Get creative

You’ve heard the expression: The best things in life are free. From homemade gifts to looking through your local paper for free events to enjoy, there are lots of creative ways to save money. Host a potluck instead of heading to a restaurant, buy the new chair you want secondhand, learn to repair your own clothing – the possibilities are endless.

7. Save automatically

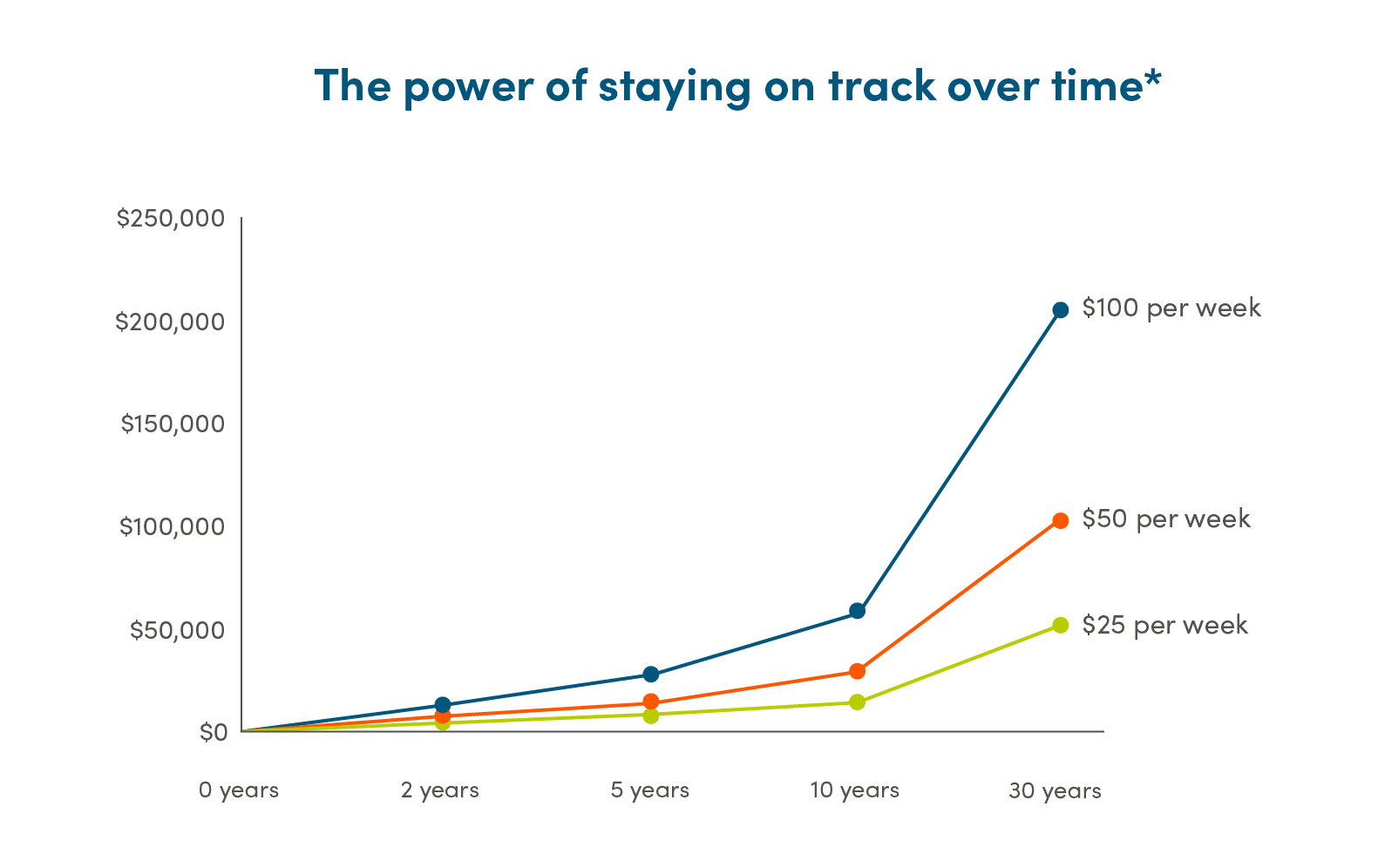

Saving is easiest when you don’t need to think about it. You won’t spend money that’s been automatically transferred to your savings account. Just set up a transfer for a set amount at select intervals – like $25 every week. Learn more about pre-authorized contributions.

Free expert advice

We’re here to answer any questions you have about saving money. Our experts can help you create a budget, plan for your saving goals, choose your best saving and investing options, and more.

Book an appointment Call us: 1-866-592-2226 Find a branch or advisor