Personal Banking at Meridian Credit Union

Small business

We’re made with Canadian owners

Discover local businesses making our communities stronger. Learn about their stories, the services they offer, and the positive impact they have on communities.

Borrow

Around here, we find ways to say yes

Financing for the things that matter to you, matters to us. Through one-on-one conversations, we match you with a competitive borrowing option that works.

Save

Get ahead while doing some good

Saving is more than money in your account. Better savings habits improve your financial confidence and your overall sense of well-being.

Spend

Around here, spending is rewarded

Get cash back when you spend money. Earn 2 reward points for every $2 spent on gas, groceries, pharmacy, and utility bill payments with our popular Meridian Visa** Cash Back Card.

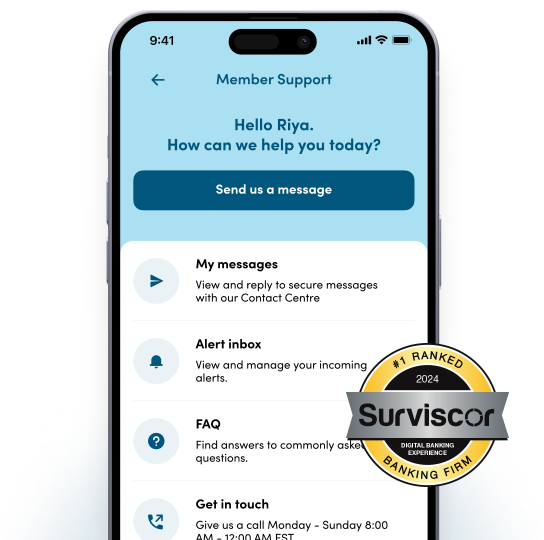

Mobile app

Secure, full-service digital banking

Alerts

Keep track of your money with transaction, security, and account balance alerts.

Card controls

Put a temporary lock on your debit card if you suspect it’s lost or stolen.

Privacy settings

Add more security with biometric and two-factor authentication.

Around here, banking is different.

Join over 380,000 Ontarians who trust Meridian to help them save, reward their spending, find the right lending options, and so much more.