In-depth survey shows Millennial anxiety may be undermining their financial success

Toronto, ON, February 8, 2022 – One of Canada’s most storied and buzzed-about generations has a strong sense of money mojo, but a new survey from Meridian finds that most Millennials admit they suffer from underlying financial anxiety.

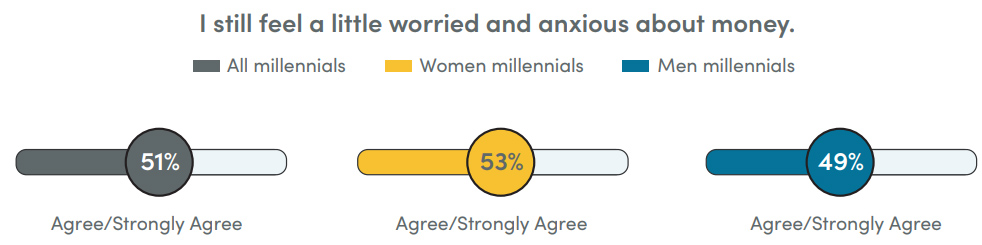

The in-depth survey fielded by Maru Public Opinion for Meridian reveals that while Millennials are proactive about their finances — and strongly value money equity, openness, and partnership — 55% of Millennials also admit they find dealing with money to be stressful and even intimidating.

“The data echoes what many Millennial investors share with us,” says Naveen Senthamilselvan, Senior Manager, Wealth Management, Meridian. “While Millennials are generally great about saving, setting financial goals and value being proactively involved in their finances and investing, they are also the most likely to admit to money doubts and anxiety, which may be holding them back from reaching their financial goals.”

Money Equality and Partnership

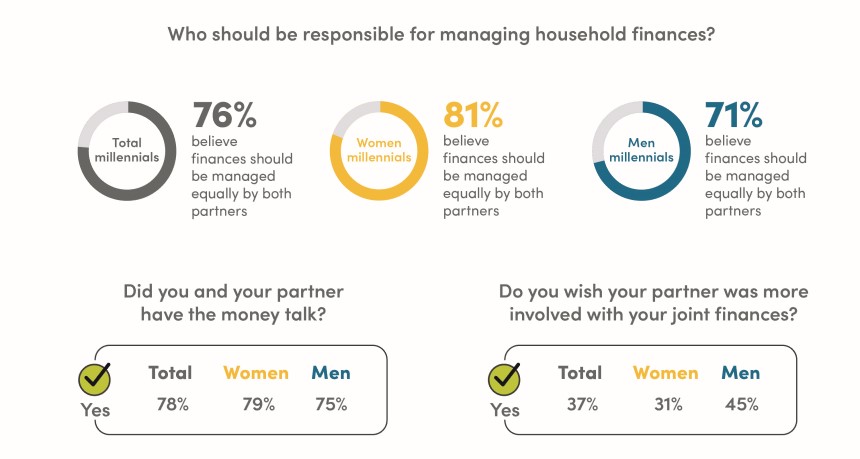

This generation’s high regard for partnership and money transparency sets them apart from other generations. Seventy-eight per cent (78%) of Millennials report they’ve had an in-depth money talk with their partner, compared to 72% of Gen Xers and only 58% of Boomers. A majority of Millennials (60%) would like to discuss financial goals together more often and 30% say they’d like to participate in joint meetings with a financial advisor, compared to 12% for GenX and 9% of Boomers surveyed.

On the topic of loans and other financial obligations, 72% of Millennials believe this should be discussed before committing to their partner; Millennial women are more eager to have full disclosure (76%) than men (68%). Millennial women are also more likely to agree that finances should be discussed openly early in dating (35% vs. 24% for Millennial men).

The survey shows a core Millennial money value is their strong belief (76%) that family finances should be managed by “both partners as equals,” a view held more strongly among Millennial women (81%) than Millennial men (71%).

For all their togetherness, Millennial men and women expect more from their partners, with 45% of Millennial men and 31% of Millennial women wishing their counterparts were more involved in their finances. Both expressed a desire for them to have more frequent conversations about financial goals and investments (60%) and have their partners become more knowledgeable about finances in general (68%).

Proactivity Undercut by Anxiety and Money Worries

Most Millennials (56%) report they learned to save and set money goals growing up and 79% of Millennials agree they felt knowledgeable about money when they left home. Of the 41% of Millennials who consider themselves to be knowledgeable about money, 60% believe it’s important to learn about and be actively involved in financial planning and investing.

Despite this, 51% report they still deal with leftover money anxiety from childhood. Millennials are the most likely to confess their parents were “always worried about money and they were too” (30%) and to reveal that money caused tension in their households growing up (20%).

While more than half (58%) of Millennials have low confidence in their level of financial knowledge, a majority (73%) still don’t use a financial planner or advisor to manage their money. Instead, 55% of Millennials prefer to manage their own money, 37% think they do not have enough money for a financial advisor, 31% worry about the cost of an advisor and 20% don’t understand what a financial advisor does.

“It’s great that Millennials value being actively involved in money and investing, and there’s tremendous benefit to learning about financial planning through independent researching, experimenting with apps and listening to others,” says Naveen. “It’s also beneficial to talk through your goals with a professional financial advisor, who can take the edge off that money anxiety, especially in these trying times. They have the advantage of knowing you personally and can suggest customized strategies to help you reach your goals and build your money confidence.”

For some basic tips and strategies designed to help Millennials lose a little edge off that money anxiety and gain confidence, see Meridian’s guide on “Saving at every life stage.”

##

Methodology:

These findings are from a study released by Maru Public Opinion undertaken by its sample and data collection experts at Maru/Blue July 27th and Aug 11th, 2021 on behalf of Meridian, among a random selection of 1509 Canadian adults who are Maru Voice Canada panelists. The results were weighted by education, age, gender, and region (and in Quebec, language) to match the population, according to Census data. For comparison purposes, a probability sample of this size has an estimated margin of error (which measures sampling variability) of +/- 2.5%, 19 times out of 20. Further details may be found at Canadian Public Opinion Polls | Maru Group

About MARU Public Opinion

MARU Public Opinion is a professional services firm dedicated to improving its clients' business outcomes. It delivers its services through teams of sector-specific research consultants specializing in the use of Insight Community and Voice of Market technology.

About Meridian

We acknowledge the land on which we operate is the traditional territory of many nations including the Mississaugas of the Credit, the Anishinaabe, the Chippewa, the Haudenosaunee and the Wendat peoples.

With more than 75 years of banking history, Meridian is Ontario's largest credit union, and second largest in Canada, helping to grow the lives of 365,000 Members. Meridian has $28.3 billion in assets under management (December 31, 2021) and delivers a full range of financial services online, by phone, by mobile and through a network of 89 branches across Ontario, and business banking services in 15 locations. Meridian cardholders also have access to over 43,000 surcharge-free ATMs in North America with THE EXCHANGE® Network and the Allpoint Network in the US. For more information, please visit: meridiancu.ca, follow us on Twitter @MeridianCU or visit us on Facebook.

For more information contact:

Teresa Pagnutti, Public Relations, Meridian

teresa.pagnutti@meridiancu.ca; 416-275-3816

Jacob Del Zotto, Corporate Communications, Meridian

Jacob.DelZotto@meridiancu.ca; 647-242-8877