April 2025 Monthly Market Insights

April 2025 Monthly Market Insights

Data and opinions as of March 31, 2025

Inflation concerns, gold’s surge, and Europe’s strategic shift

March 2025 was a month defined by diverging central bank actions, escalating inflation expectations, and a massive shift in European defense policy. Inflation continues to loom large in investor sentiment, fueled in part by tariff policies and geopolitical uncertainties. Meanwhile, gold emerged as a standout performer, benefiting from its traditional safe-haven status as well as increasing institutional and retail interest. Europe took centerstage with a landmark defense budget approval, signaling a deeper decoupling from the U.S. and offering fresh momentum to regional equities. Central banks around the world—namely the U.S. Federal Reserve (Fed), European Central Bank (ECB), Bank of England (BoE), and Bank of Canada (BoC)—issued key policy updates, keeping investors focused on interest rate paths and inflation outlooks through year-end.

NEI perspectives

Inflation expectations rising: Inflation is reaccelerating in the face of tariff-related pressures and strong wage growth. Market-based expectations and consumer sentiment indicators are aligning toward the possibility of more persistent inflation. Bottom line: Investors should prepare for prolonged inflation uncertainty, with diversification and inflation-hedging strategies increasingly valuable.

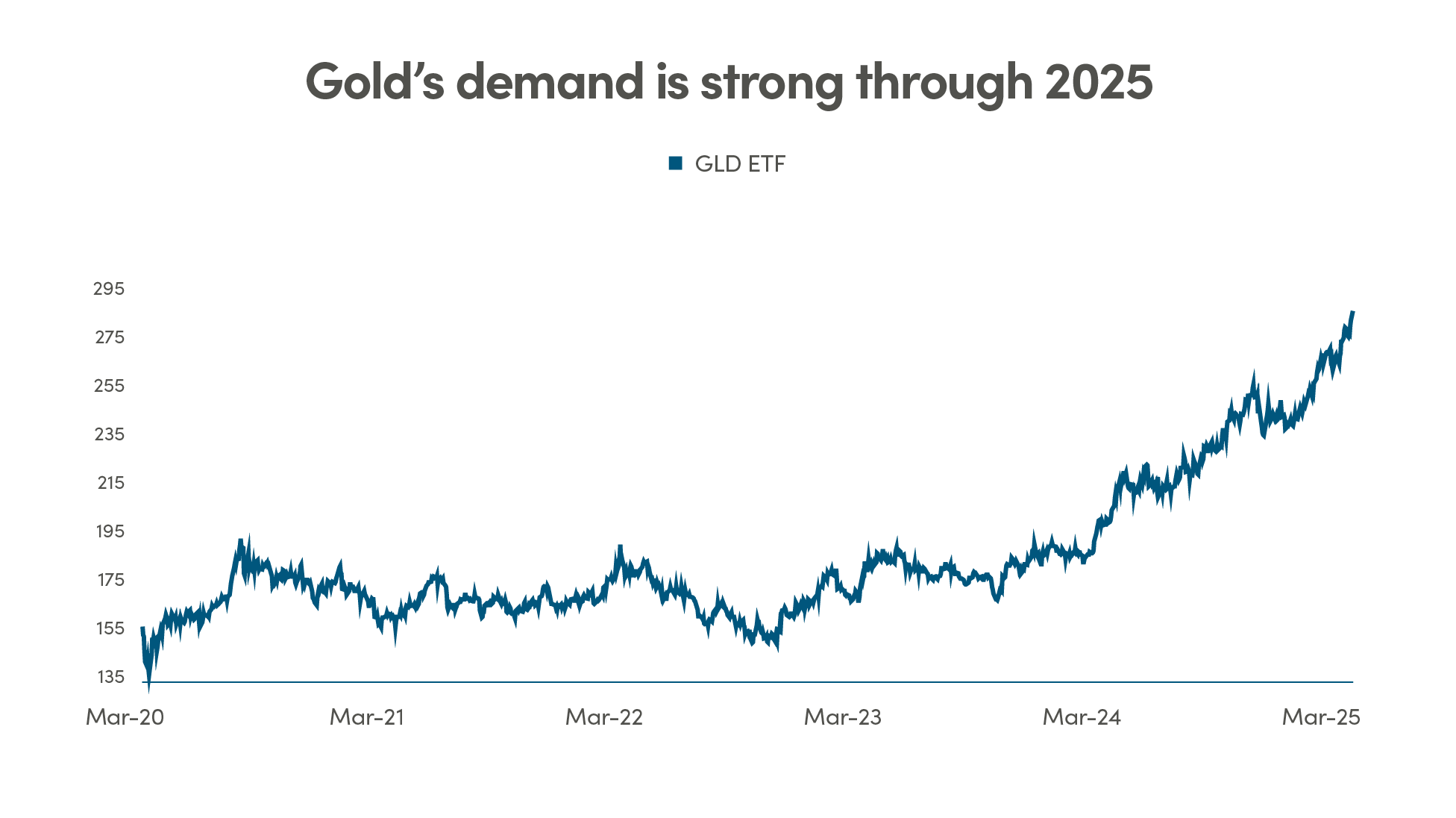

Gold’s resurgence: Gold has reasserted its role as a strategic asset, benefiting from safe-haven flows, central bank demand, and inflation concerns. Bottom line: Gold may continue to offer relative strength amid macro uncertainty, serving both as a hedge and performance contributor.

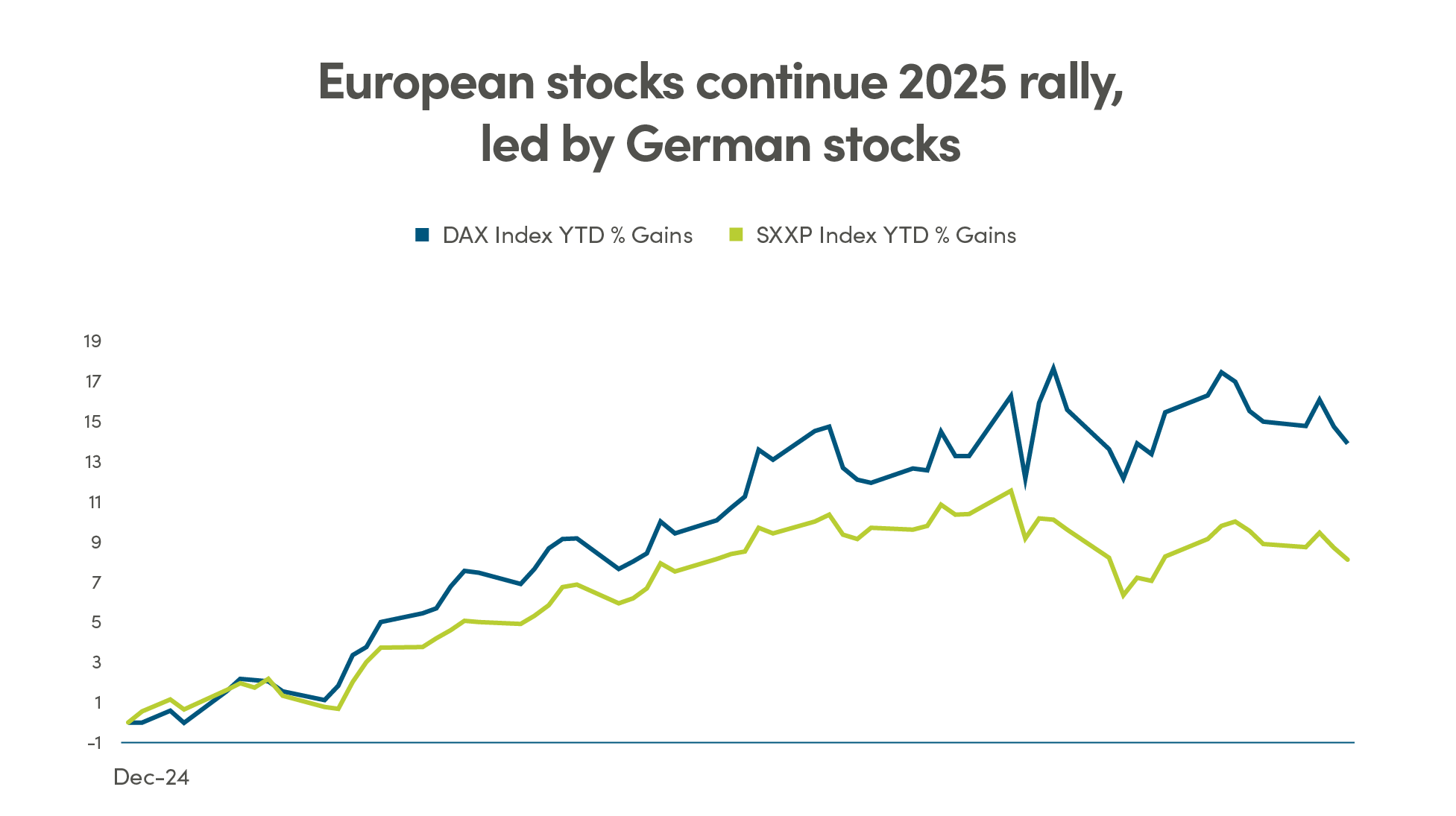

Europe’s policy pivot: A historic surge in German defense spending has broader implications for European equities and policy independence. Bottom line: Structural policy shifts in Europe are supporting equity strength and may continue to drive capital rotation into the region.

‒ NEI Asset Allocation team

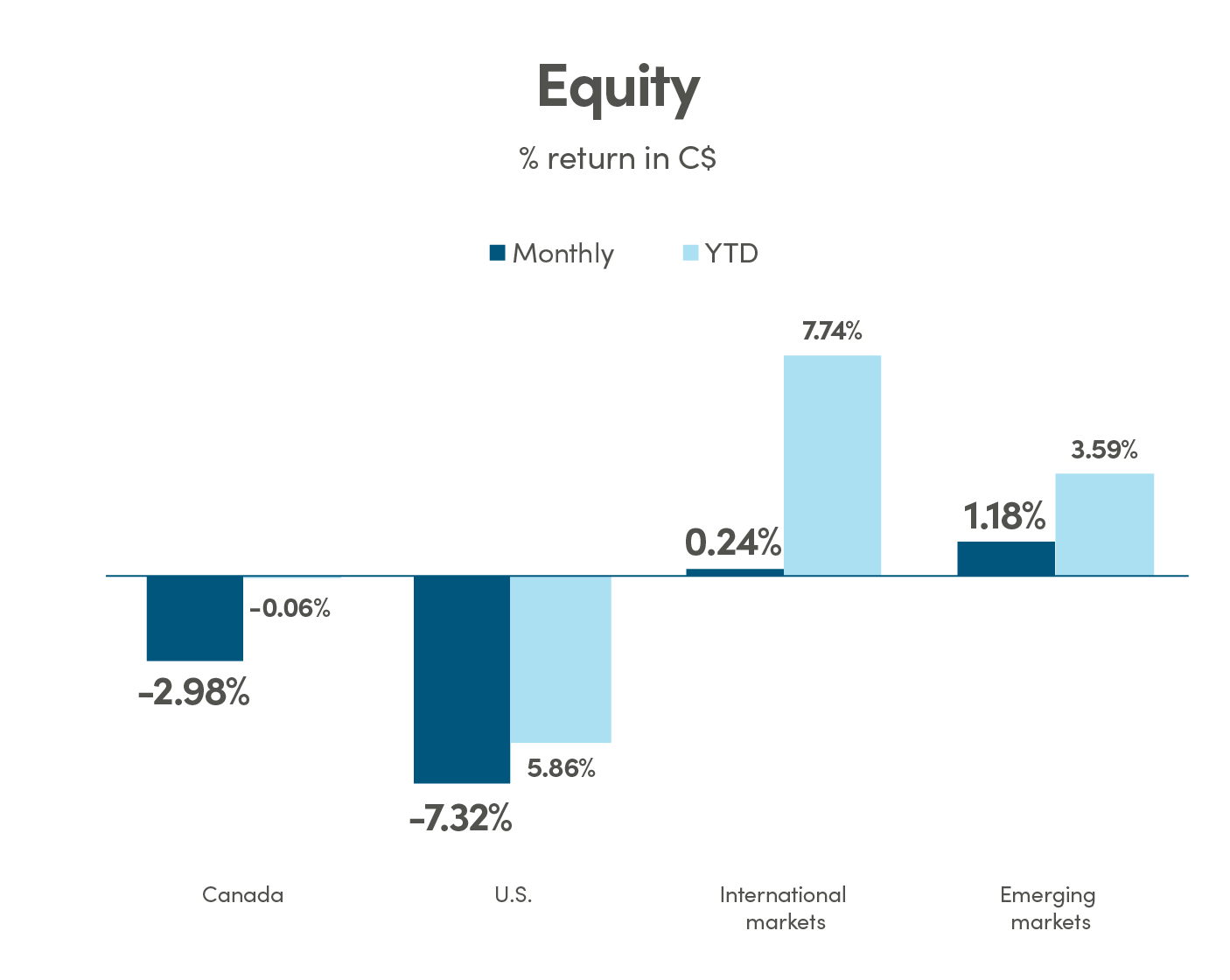

Canada: MSCI Canada Index TR; U.S.: MSCI USA Index TR International: MSCI EAFE Index TR; Emerging markets: MSCI Emerging Markets Index TR.

Source: Morningstar Direct

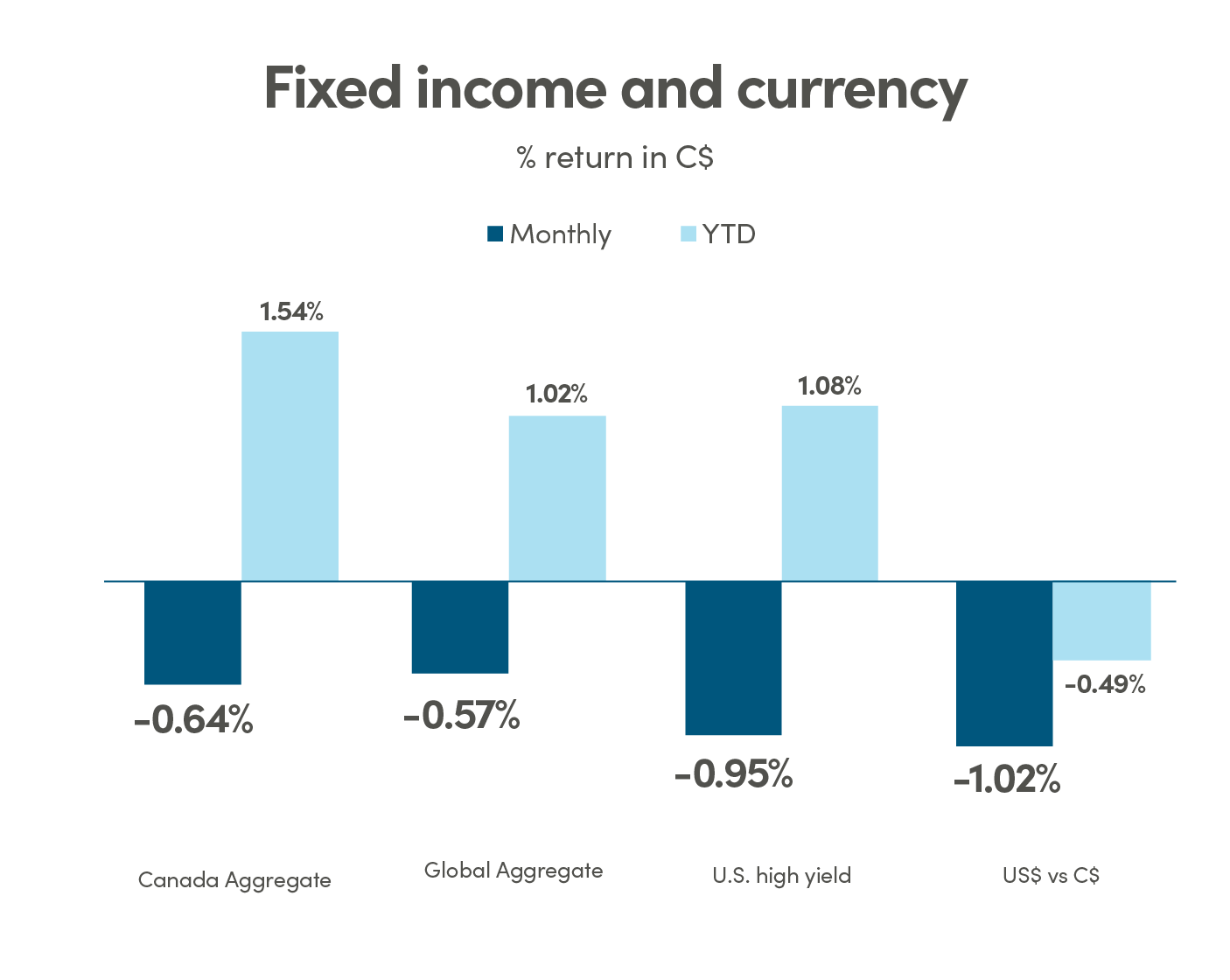

Canada Aggregate: Bloomberg Barclays Canada Aggregate Bond Index; Global Aggregate: Bloomberg Barclays Global Aggregate Bond Index; U.S. High Yield: Bloomberg Barclays U.S. High Yield Index.

Source: Morningstar Direct

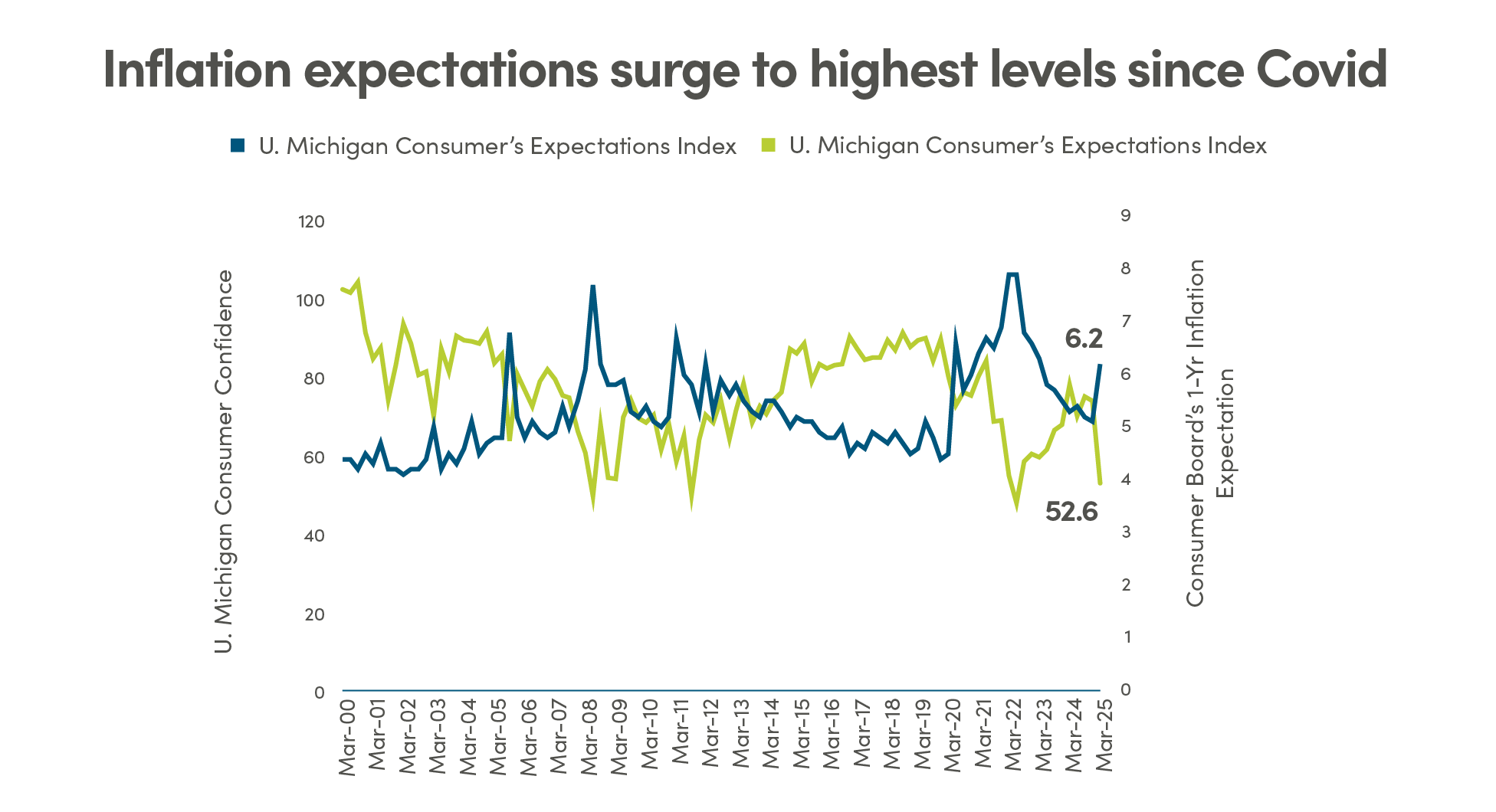

Inflation concerns resurface across global markets

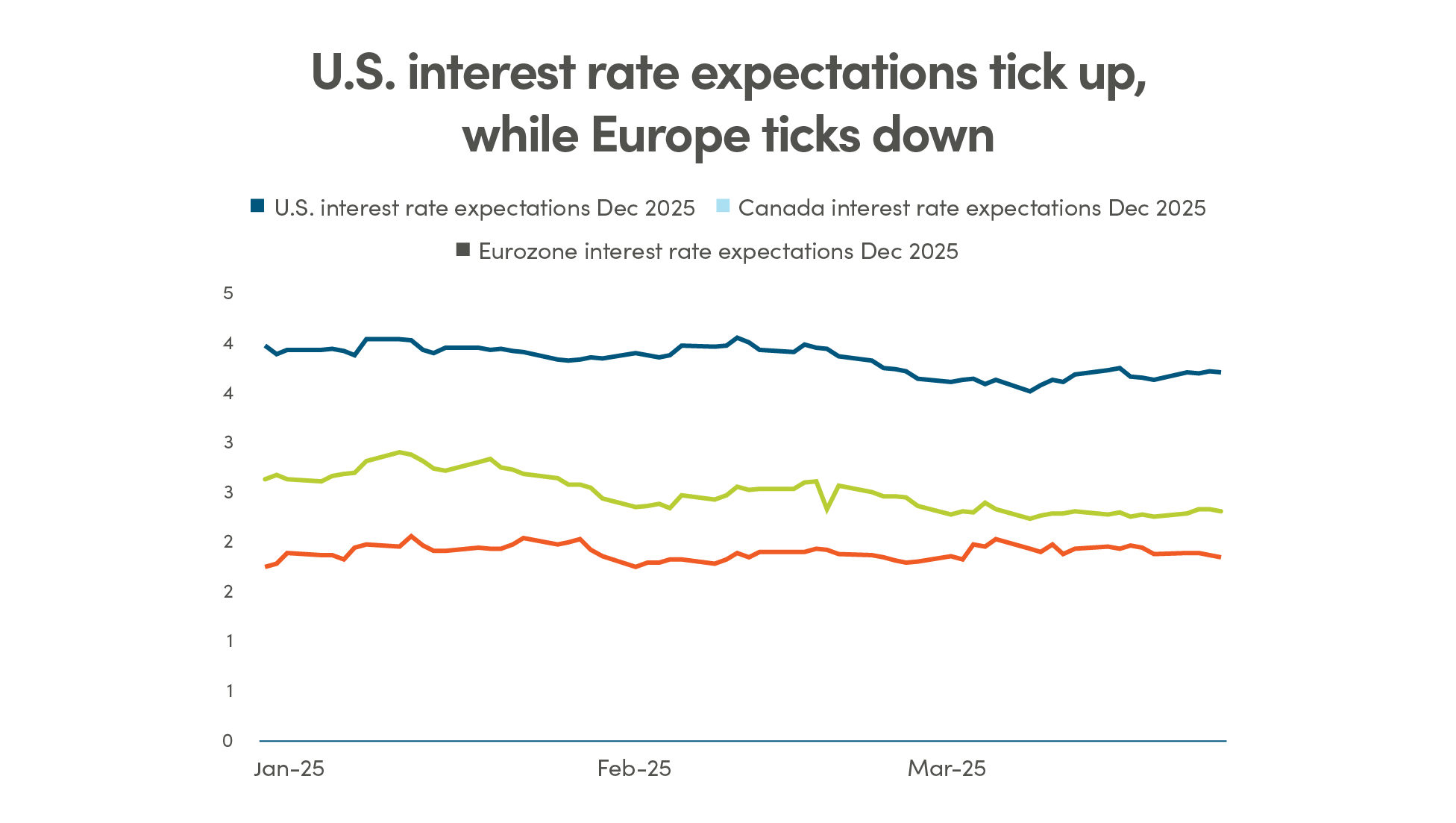

March saw a renewed focus on inflation as fresh economic data and forward guidance from major central banks pointed to a potentially more entrenched price environment. For example, University of Michigan’s consumer sentiment survey showed a notable downturn, and the Conference Board Inflation Expectation index sharply ticked up. Meanwhile, market-based indicators such as breakeven inflation rates and rate futures have adjusted accordingly, with the probability of higher global interest rates into December 2025 increasing.

Tariffs, especially those impacting energy, agricultural goods, and semiconductors, have introduced new upward pressure on prices. Supply chain friction and geopolitical uncertainty are also exacerbating inflation dynamics, making it increasingly likely that central banks will need to remain vigilant—despite prior easing signals.

Central banks diverged in March: the Fed held rates steady but warned that further action may be needed if inflation accelerates. The ECB and BoE both signalled caution, with the ECB notably pointing to tariff-related risks. The BoC delivered a modest ratecut, citing domestic economic resilience and softer core inflation—but even they acknowledged that external inflation pressures complicate the path forward.

Bottom line: Investors face a higher-for-longer inflation scenario, with implications for both fixed income and equity positioning. Tactically, inflation-hedging assets and active management may outperform in this regime.

Source: Bloomberg

Gold’s multi-faceted rally continues

Gold extended its strong year-to-date performance in March, breaking through key technical resistance levels and posting double-digit gains. A combination of factors contributed to this surge: increasing inflation expectations, rising geopolitical risks, and sustained central bank purchases globally. Notably, several emerging market central banks added to reserves, citing a desire for diversification away from U.S. dollar-denominated assets.

Gold’s traditional role as a safe haven asset has also been amplified in today’s environment. Retail and institutional flows into gold ETFs rose significantly over the month, with investors seeking protection against both macroeconomic volatility and equity market pullbacks.

In addition, as real yields began to level off, the opportunity cost of holding gold became less punitive, further enhancing its relative attractiveness. With uncertainty looming over both inflation and monetary policy, gold appears to be regaining its strategic allure.

Bottom line: With a backdrop of sticky inflation, geopolitical volatility, and robust central bank demand, gold remains a valuable diversifier and a potential outperformer in multi-asset portfolios.

Source: Bloomberg

Europe’s strategic breakaway: defense spending lifts markets

European markets outperformed in March, with Germany’s landmark €1 trillion defense budget announcement acting as a key catalyst. This unprecedented fiscal commitment marks a major policy shift, signaling a stronger, more independent European security posture. The move is widely seen as a response to growing geopolitical tensions and a desire to reduce dependency on U.S. defense guarantees.

Equity markets responded positively. Germany’s DAX index rallied sharply, lifting broader European equities as investors interpreted the budget as both a near-term stimulus and a long-term structural shift. Sectors likely to benefit include defense, aerospace, infrastructure, and industrials.

The announcement also adds new dimensions to the transatlantic relationship, as Europe increasingly charts its own economic and geopolitical path. Combined with improving earnings and continued ECB support, the defense pivot reinforces the investment case for European equities relative to their North American counterparts.

Bottom line: Europe’s evolving policy landscape and improving equity fundamentals make it an increasingly attractive destination for global capital. Structural tailwinds may support sustained outperformance, especially in strategically aligned sectors.

Legal

Aviso Wealth Inc. (“Aviso”) is the parent company of Aviso Financial Inc. (“AFI”) and Northwest & Ethical Investments L.P. (“NEI”). Aviso and Aviso Wealth are registered trademarks owned by Aviso Wealth Inc. NEI Investments is a registered trademark of NEI. Any use by AFI or NEI of an Aviso trade name or trademark is made with the consent and/or license of Aviso Wealth Inc. Aviso is a wholly-owned subsidiary of Aviso Wealth LP, which in turn is owned 50% by Desjardins Financial Holding Inc. and 50% by a limited partnership owned by the five Provincial Credit Union Centrals and The CUMIS Group Limited.

This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax or similar matters. This document is published by AFI and unless indicated otherwise, all views expressed in this document are those of AFI. The views expressed herein are subject to change without notice as markets change over time. Views expressed regarding a particular industry or market sector should not be considered an indication of trading intent of any funds managed by NEI Investments. Forward-looking statements are not guaranteed of future performance and risks and uncertainties often cause actual results to differ materially from forward-looking information or expectations. Do not place undue reliance on forward-looking information. Mutual funds and other securities are offered through Aviso Financial Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual fund securities and cash balances are not insured nor guaranteed, their values change frequently and past performance may not be repeated.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to computing, computing or creating any MCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages.

©2025 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar Research Services LLC, Morningstar, Inc. and/or their content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar Research Services, Morningstar nor their content providers are responsible for any damages or losses arising from any use of this information. Access to or use of the information contained herein does not establish an advisory or fiduciary relationship with Morningstar Research Services, Morningstar, Inc. or their content providers. Past performance is no guarantee of future results.