July 2023 monthly market insights

Data and opinions as of June 30, 2023

Markets continue to rally through June

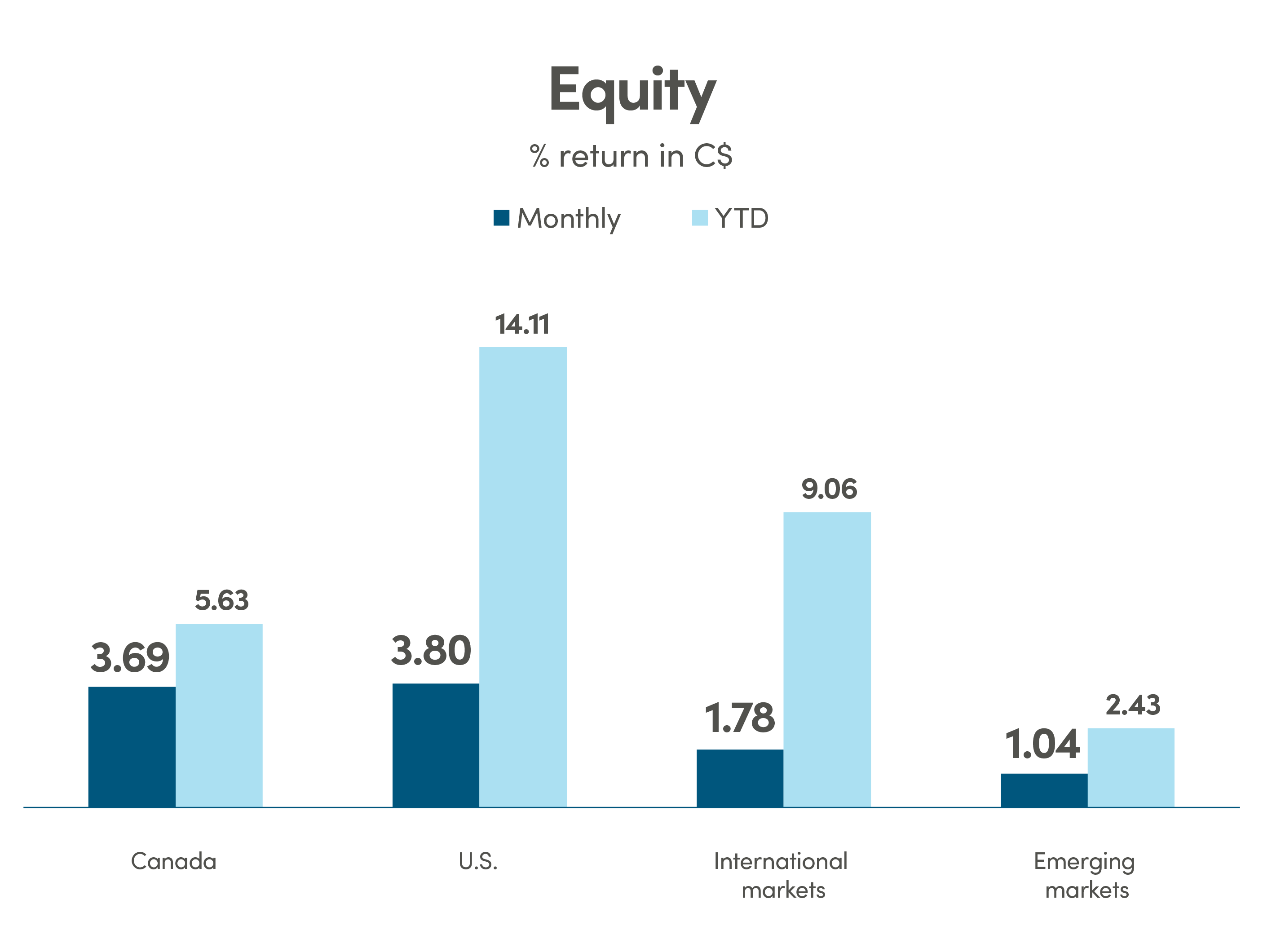

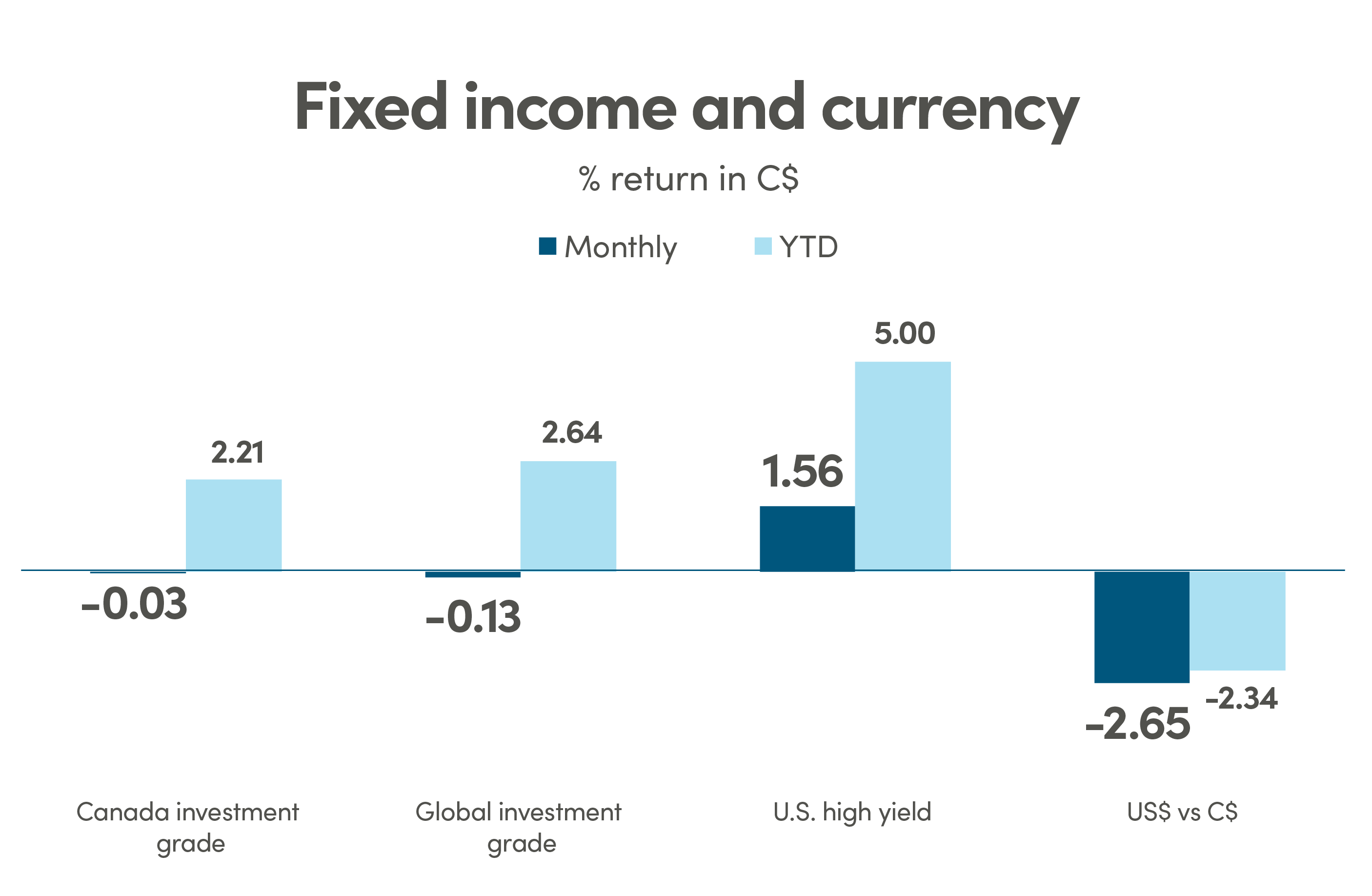

Equity markets had another positive month as the S&P 500 was up 6% in June, bringing year-to-date returns to 14.5%, while the Nasdaq is officially back in bull market territory, up 36.7% year-to-date. Equity markets were up across the board in Europe, Canada, Japan, and Emerging Markets while China was down for the month. Better-than-expected economic conditions in the first half of 2023 has also contributed to this dynamic. The U.S. Economic Surprise Index has surged, indicating that economic data releases have been coming in above consensus forecasts. The previous concerns about an impending recession seem to have diminished, or at least expectations for a recession have been pushed out further to a later date. Fixed income markets ended the month lower as yields surged on strong economic data, raising expectations that central banks will need to stay hawkish for longer.

The NEI perspective

U.S. market rallied past the trading range ceiling of 4200 that it had previously and entered a technical bull market after returning over 24% since hitting a low in October. While the performance of AI exposed mega-cap technology companies has led the markets, the rally has recently broadened.

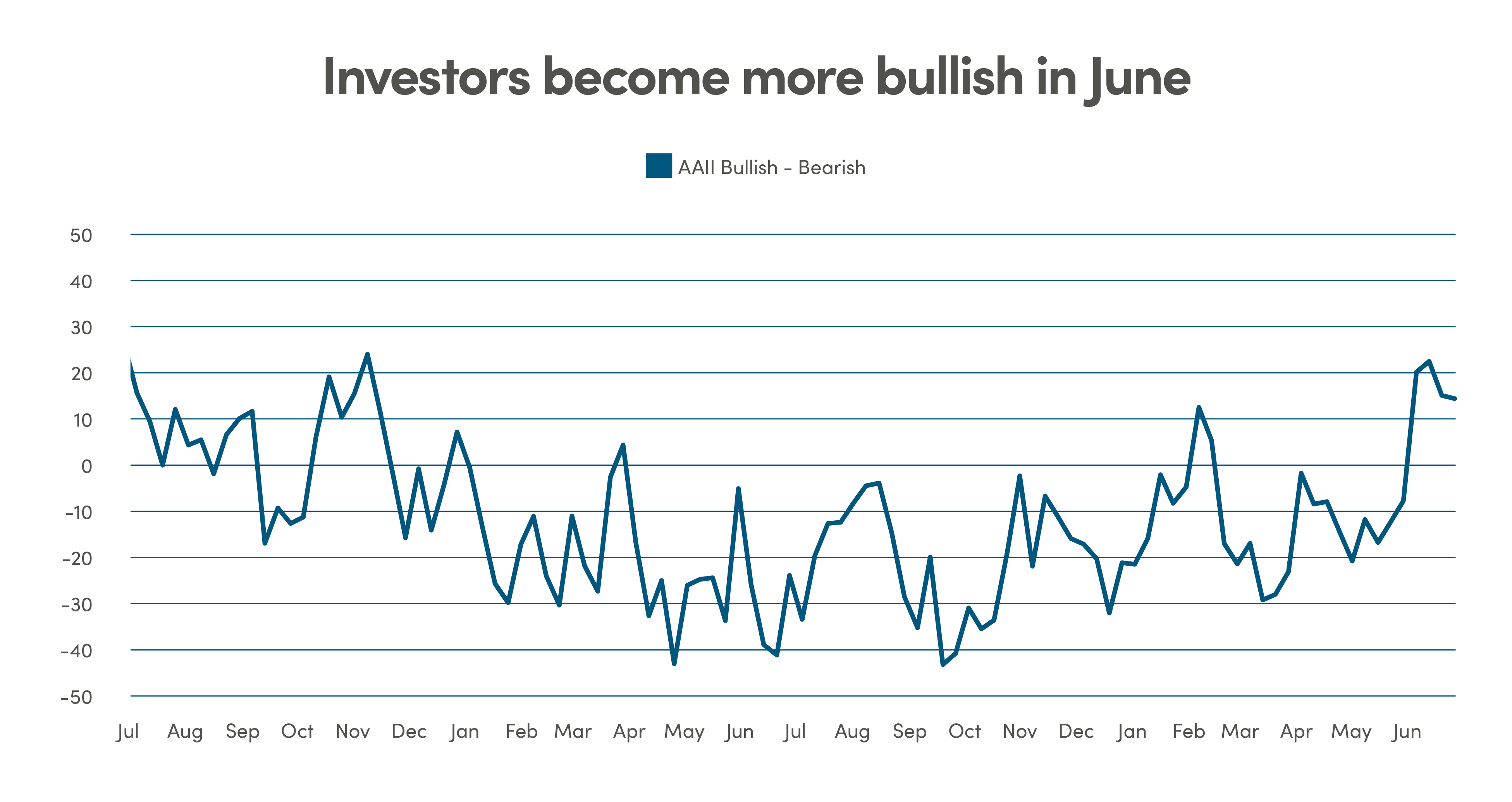

Market strength buoys investment sentiment as market sentiment has shifted from having more investors in the bearish camp, to having the majority of investors turning bullish over the past few months. In June, bullish sentiment was at its highest level since November 2021.

How sustainable is this rally? Excess savings, a tight labour market, reasonable valuations (outside of the mega cap technology companies) and the low bar set for earnings expectations indicate that the market may continue to rally in the near term.

From NEI’s Monthly Market Monitor for June

Canada: MSCI Canada; U.S.: MSCI USA; International markets: MSCI EAFE; Emerging markets: MSCI Emerging Markets. Source: Morningstar Direct

Canada investment grade: Bloomberg Barclays Canada Aggregate; Global investment grade: Bloomberg Barclays Global Aggregate; U.S. high yield:Bloomberg Barclays U.S. High Yield. Source: Morningstar Direct.

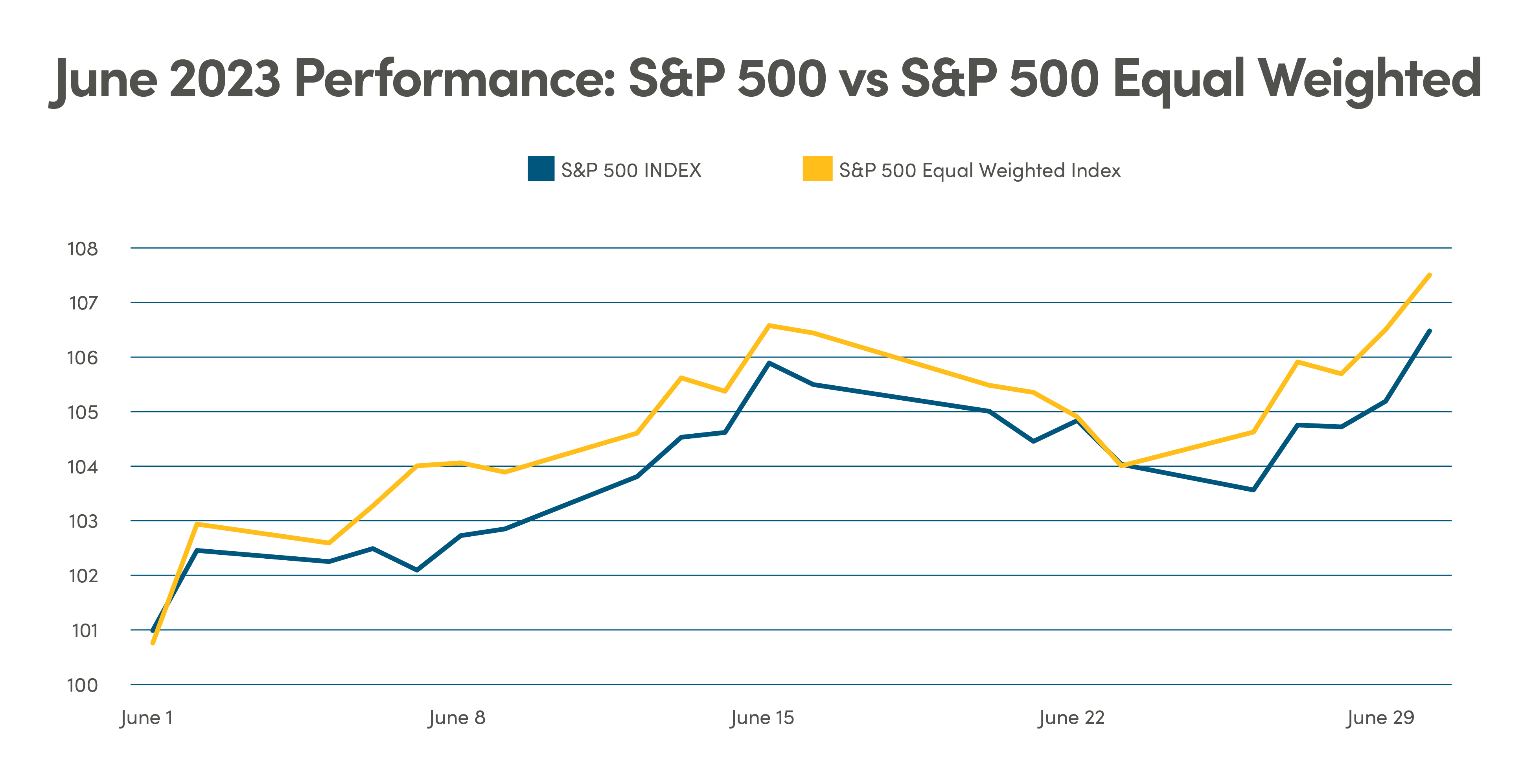

U.S market starting to see improvement in breadth

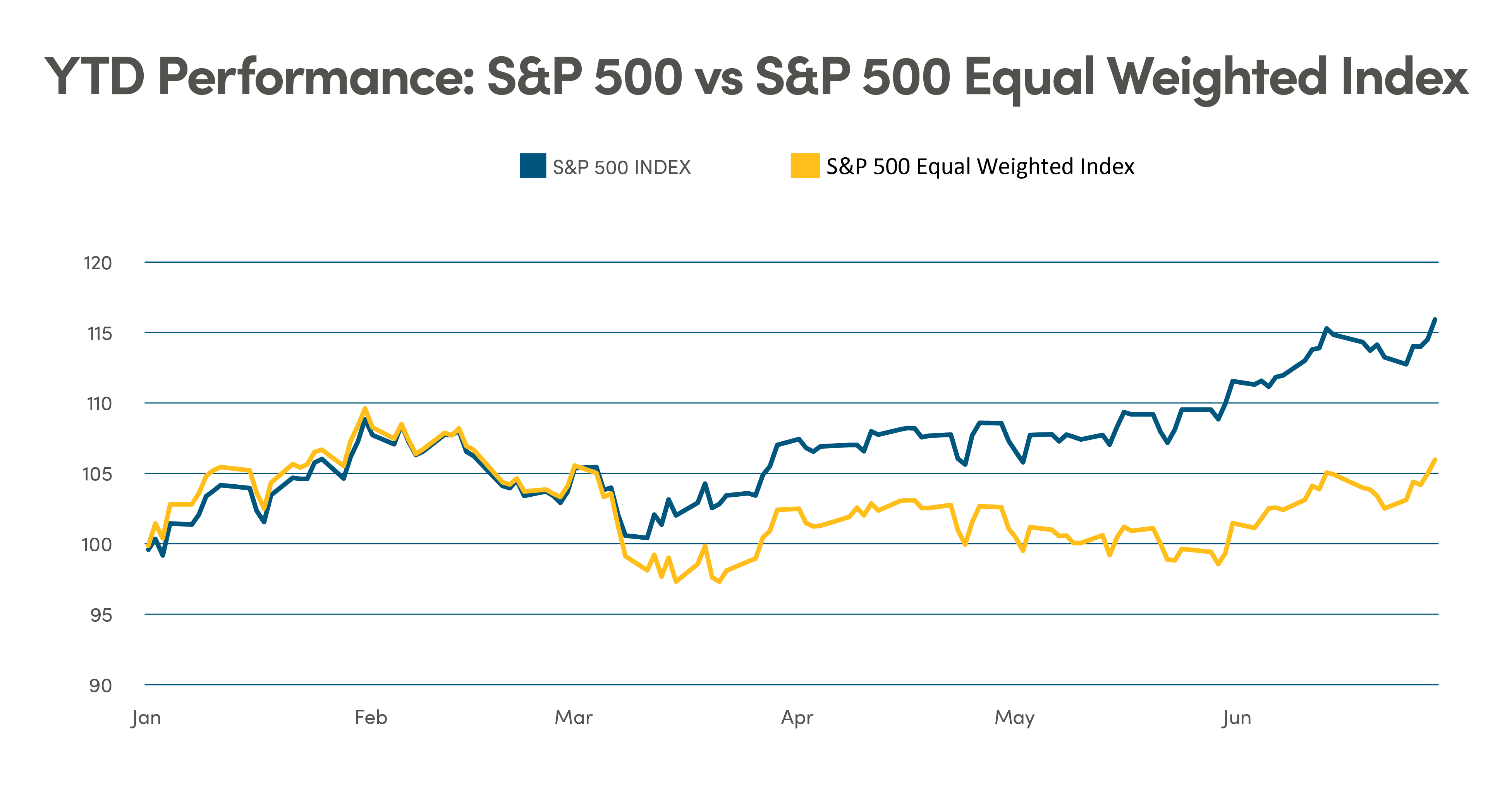

The S&P 500 Index broke out of its 3800-4200 trading range and entered a technical bull market after returning over 24% since hitting a low in October. While the performance of AI exposed mega-cap technology companies has led the markets, the rally has recently broadened with the equal-weighted index outperforming the market-weighted index in June, pointing to an improvement in breadth and potential for continued upside.

Source: Source: Bloomberg data as of May 31, 2023

As recently as late May, the equal weighted index was flat on a year-to-date (YTD) performance basis.

Source: Bloomberg data as of June 30, 2023

Market strength buoys investment sentiment

Over the course of the past few months, market sentiment has shifted from having more investors in the bearish camp, to having the majority of investors turning bullish. In June, bullish sentiment was at its highest level since November 2021. In other words, this is the most positive investors have been on the markets in almost two years. This can also be seen in investor flows. After several months of outflows, investors moved off of the sidelines and invested into equities in June.

Source: Bloomberg data as of June 30, 2023

Earnings expectations are overly bearish

The market is expecting companies to report a 9% year-over-year decline in the upcoming Q2 earnings season in July, driven by flat sales growth and margin compression. We believe this is a relatively low bar and companies should be able to beat consensus which provides support for equity upside. The key is the companies’ go forward guidance over the next 12 to 18 months in earnings trajectory. Analysts have been consistently revising earnings estimates downward and they may have reached bottom for this year and next year’s estimates. An upward revision in forward earnings estimates would provide the equity markets with a boost in sentiment.

Legal

Aviso Wealth Inc. (“Aviso”) is the parent company of Aviso Financial Inc. (“AFI”) and Northwest & Ethical Investments L.P. (“NEI”). Aviso and Aviso Wealth are registered trademarks owned by Aviso Wealth Inc. NEI Investments is a registered trademark of NEI. Any use by AFI or NEI of an Aviso trade name or trademark is made with the consent and/or license of Aviso Wealth Inc. Aviso is a wholly-owned subsidiary of Aviso Wealth LP, which in turn is owned 50% by Desjardins Financial Holding Inc. and 50% by a limited partnership owned by the five Provincial Credit Union Centrals and The CUMIS Group Limited.

This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax or similar matters. This document is published by AFI and unless indicated otherwise, all views expressed in this document are those of AFI. The views expressed herein are subject to change without notice as markets change over time. Views expressed regarding a particular industry or market sector should not be considered an indication of trading intent of any funds managed by NEI Investments. Forward-looking statements are not guaranteed of future performance and risks and uncertainties often cause actual results to differ materially from forward-looking information or expectations. Do not place undue reliance on forward-looking information. Mutual funds and other securities are offered through Aviso Financial Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual fund securities and cash balances are not insured nor guaranteed, their values change frequently and past performance may not be repeated.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to computing, computing or creating any MCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages.